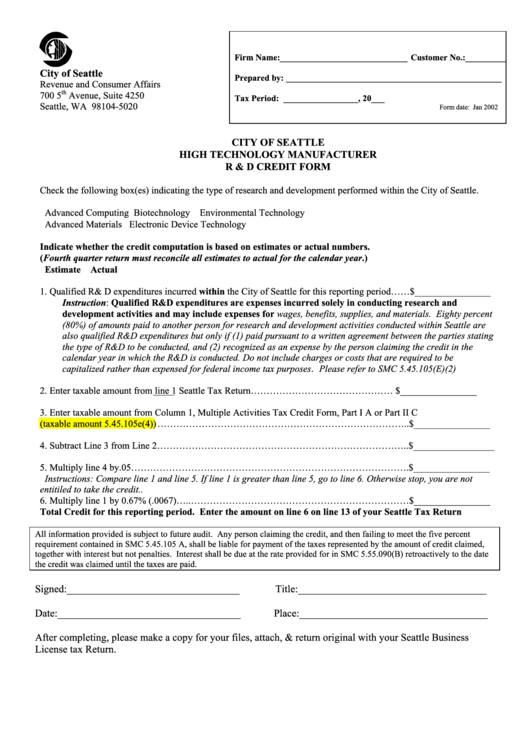

City Of Seattle High Technology Manufacturer R & D Credit Form - 2002

ADVERTISEMENT

Firm Name:_____________________________ Customer No.:__________

City of Seattle

Prepared by: _________________________________________________

Revenue and Consumer Affairs

th

700 5

Avenue, Suite 4250

Tax Period: _________________, 20___

Seattle, WA 98104-5020

Form date: Jan 2002

CITY OF SEATTLE

HIGH TECHNOLOGY MANUFACTURER

R & D CREDIT FORM

Check the following box(es) indicating the type of research and development performed within the City of Seattle.

Advanced Computing Biotechnology

Environmental Technology

Advanced Materials

Electronic Device Technology

Indicate whether the credit computation is based on estimates or actual numbers.

(Fourth quarter return must reconcile all estimates to actual for the calendar year.)

Estimate

Actual

1. Qualified R& D expenditures incurred within the City of Seattle for this reporting period……$________________

Instruction: Qualified R&D expenditures are expenses incurred solely in conducting research and

development activities and may include expenses for wages, benefits, supplies, and materials. Eighty percent

(80%) of amounts paid to another person for research and development activities conducted within Seattle are

also qualified R&D expenditures but only if (1) paid pursuant to a written agreement between the parties stating

the type of R&D to be conducted, and (2) recognized as an expense by the person claiming the credit in the

calendar year in which the R&D is conducted. Do not include charges or costs that are required to be

capitalized rather than expensed for federal income tax purposes. Please refer to SMC 5.45.105(E)(2)

2. Enter taxable amount from line 1 Seattle Tax Return……………………………………… $________________

3. Enter taxable amount from Column 1, Multiple Activities Tax Credit Form, Part I A or Part II C

(taxable amount 5.45.105e(4)) ……………………………………………………………………..$________________

4. Subtract Line 3 from Line 2……………………………………………………………………..$_________________

5. Multiply line 4 by.05…………………………………………………………………………….$________________

Instructions: Compare line 1 and line 5. If line 1 is greater than line 5, go to line 6. Otherwise stop, you are not

entitiled to take the credit..

6. Multiply line 1 by 0.67% (.0067)…..……………………………………………………………$________________

Total Credit for this reporting period. Enter the amount on line 6 on line 13 of your Seattle Tax Return

All information provided is subject to future audit. Any person claiming the credit, and then failing to meet the five percent

requirement contained in SMC 5.45.105 A, shall be liable for payment of the taxes represented by the amount of credit claimed,

together with interest but not penalties. Interest shall be due at the rate provided for in SMC 5.55.090(B) retroactively to the date

the credit was claimed until the taxes are paid.

Signed:_________________________________

Title:____________________________________

Date:___________________________________

Place:____________________________________

After completing, please make a copy for your files, attach, & return original with your Seattle Business

License tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1