Instructions For Form 89-140 - Mississippi Income Tax Withheld

ADVERTISEMENT

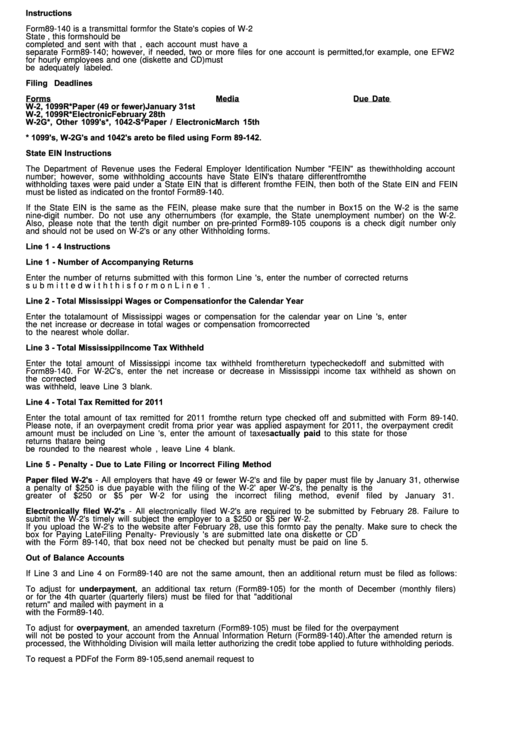

Instructions

Form 89-140 is a transmittal form for the State's copies of W-2 statements. Federal forms may not be substituted for

State forms. If you are required to submit copies of withholding statements using electronic media, this form should be

completed and sent with that media. If multiple accounts are on one electronic media, each account must have a

separate Form 89-140; however, if needed, two or more files for one account is permitted, for example, one EFW2

for hourly employees and one W2REPORT-11.xls for salary employees. All electronic media (diskette and CD) must

be adequately labeled.

Filing Deadlines

Forms

Media

Due Date

W-2, 1099R*

Paper (49 or fewer)

January 31st

W-2, 1099R*

Electronic

February 28th

W-2G*, Other 1099's*, 1042-S*

Paper / Electronic

March 15th

* 1099's, W-2G's and 1042's are to be filed using Form 89-142.

State EIN Instructions

The Department of Revenue uses the Federal Employer Identification Number "FEIN" as the withholding account

number; however, some withholding accounts have State EIN's that are different from the FEIN. If Mississippi

withholding taxes were paid under a State EIN that is different from the FEIN, then both of the State EIN and FEIN

must be listed as indicated on the front of Form 89-140.

If the State EIN is the same as the FEIN, please make sure that the number in Box 15 on the W-2 is the same

nine-digit number. Do not use any other numbers (for example, the State unemployment number) on the W-2.

Also, please note that the tenth digit number on pre-printed Form 89-105 coupons is a check digit number only

and should not be used on W-2's or any other Withholding forms.

Line 1 - 4 Instructions

Line 1 - Number of Accompanying Returns

Enter the number of returns submitted with this form on Line 1. For W-2C's, enter the number of corrected returns

submitted with this form on Line 1.

Line 2 - Total Mississippi Wages or Compensation for the Calendar Year

Enter the total amount of Mississippi wages or compensation for the calendar year on Line 2. For W-2C's, enter

the net increase or decrease in total wages or compensation from corrected returns. All amounts must be rounded

to the nearest whole dollar.

Line 3 - Total Mississippi Income Tax Withheld

Enter the total amount of Mississippi income tax withheld from the return type checked off and submitted with

Form 89-140. For W-2C's, enter the net increase or decrease in Mississippi income tax withheld as shown on

the corrected returns. All amounts must be rounded to the nearest whole dollar. If no Mississippi income tax

was withheld, leave Line 3 blank.

Line 4 - Total Tax Remitted for 2011

Enter the total amount of tax remitted for 2011 from the return type checked off and submitted with Form 89-140.

Please note, if an overpayment credit from a prior year was applied as payment for 2011, the overpayment credit

amount must be included on Line 4. For W-2C's, enter the amount of taxes actually paid to this state for those

returns that are being amended. Interest and penalty must not be included in these amounts. All amounts must

be rounded to the nearest whole dollar. If no Mississippi withholding tax was paid for 2011, leave Line 4 blank.

Line 5 - Penalty - Due to Late Filing or Incorrect Filing Method

Paper filed W-2's - All employers that have 49 or fewer W-2's and file by paper must file by January 31, otherwise

a penalty of $250 is due payable with the filing of the W-2's. If filing 50 or more paper W-2's, the penalty is the

greater of $250 or $5 per W-2 for using the incorrect filing method, even if filed by January 31.

Electronically filed W-2's - All electronically filed W-2's are required to be submitted by February 28. Failure to

submit the W-2's timely will subject the employer to a penalty. This penalty is the greater of $250 or $5 per W-2.

If you upload the W-2's to the website after February 28, use this form to pay the penalty. Make sure to check the

box for Paying Late Filing Penalty - Previously Filed Returns. If the W-2's are submitted late on a diskette or CD

with the Form 89-140, that box need not be checked but penalty must be paid on line 5.

Out of Balance Accounts

If Line 3 and Line 4 on Form 89-140 are not the same amount, then an additional return must be filed as follows:

To adjust for underpayment, an additional tax return (Form 89-105) for the month of December (monthly filers)

or for the 4th quarter (quarterly filers) must be filed for that period. The Form 89-105 must be marked "additional

return" and mailed with payment in a separate envelope. Please do not mail the Form 89-105 in the same envelope

with the Form 89-140.

To adjust for overpayment, an amended tax return (Form 89-105) must be filed for the overpayment period. Credit

will not be posted to your account from the Annual Information Return (Form 89-140). After the amended return is

processed, the Withholding Division will mail a letter authorizing the credit to be applied to future withholding periods.

To request a PDF of the Form 89-105, send an email request to withholding@dor.ms.gov.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2