Form F8 - Financial Statement - Supreme Court Of British Columbia Page 4

ADVERTISEMENT

Page 4

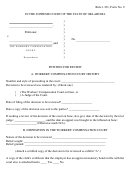

Form F8 – Financial Statement

C.

ANNUAL INCOME

If line 150 (total income) of your most recent federal income tax return sets out what you expect your income will be for this year and

you are not obliged under Note 1 below to complete Schedule A of this Form, ignore lines 1 to 7 below and record the number from line

150 of your most recent federal income tax return at line 8 below. Otherwise, record what you expect your income for this year to be

from each of the following sources of income that applies to you. Record gross annual amounts.

LINE GUIDELINE INCOME FOR BASIC CHILD SUPPORT CLAIM

Sources and amounts of annual income

1

Employment income

paid:

monthly

twice each month

every 2 weeks

weekly

annually

+

$0.00

2

Employment insurance benefits

+

3

Workers’ compensation benefits

+

4

Interest and investment income

+

5

Pension income

+

6

Social assistance income relating to self

+

7

Other income (attach Schedule A) – see Note 1

+

$0.00

8

Child support guidelines income before adjustments

=

$0.00

(If you are required to complete lines 1 through 7 above, total the amounts of those lines here.

Otherwise, record the number from line 150 of your most recent federal

►

income tax return)

Line 150 Income (if applicable)

Adjustments to income

9

Subtract union and professional dues

-

10

Adjustments in accordance with Schedule III of the Guidelines per line 8

+

$0.00

of Schedule B (attached) – see Note 2

11

Child support guidelines income for basic child support

=

$0.00

(line 8 as adjusted by lines 9 and 10)

CHILD SUPPORT GUIDELINE INCOME TO DETERMINE SPECIAL EXPENSES

Child support guideline income (from line 11 of this table)

+

$0.00

12

Add spousal support received from the other party to the family law case

+

13

Subtract spousal support paid to the other party to the family law case

-

14

Add Universal Child Care Benefits relating to children for whom special or

+

extraordinary expenses are sought

15

Child support guidelines income to determine special expenses

=

$0.00

(line 11 as adjusted by lines 12, 13 and 14)

INCOME TO BE INCLUDED FOR SPOUSAL SUPPORT CLAIM

Child support guideline income (from line 11 of this table)

+

$0.00

16

Total child support received

+

17

Social assistance received for other members of household

+

18

Child Tax Benefit and BC Family Bonus

+

19

Total income to be used for a spousal support claim

=

$0.00

(line 11 plus lines 16, 17 and 18)

Note:

1.

You must complete Schedule A of this Form and include, at line 7 above, the total income recorded at line 11 of

Schedule A, if you expect to receive income this year from any of the following sources:

(a)

taxable dividends from Canadian corporations;

(e)

registered retirement savings income;

(b)

net partnership income (limited or non-active

(f)

self-employment income;

partners only);

(g)

any other taxable income that is not included in

(c)

rental income;

paragraphs (a) to (f) or in lines 1 to 5 of Schedule A.

(d)

taxable capital gains;

2.

If there are any adjustments as set out in Schedule III of the child support guidelines that apply to you, you must

(a)

complete Schedule B of this Form, and

(b)

include at line 10 above, the amount recorded at line 8 of that completed Schedule B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12