Form F8 - Financial Statement - Supreme Court Of British Columbia Page 8

ADVERTISEMENT

Page 8

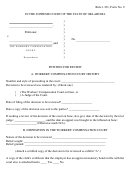

Form F8 – Financial Statement

PART 3 – PROPERTY

ASSETS

1. Real Estate

Attach a copy of the most recent assessment notice for any property that you own or in which you have an

•

interest.

Provide details, including address or legal description and nature of interest, of any interest you have in land,

•

including leasehold interests and mortgages, whether or not you are registered as owner.

Record the estimated market value of your interest without deducting encumbrances or costs of disposition.

•

(Record encumbrances under DEBTS below.)

Date Acquired

Value

Details

Real estate Sub-total

$0.00

2. Vehicles

List cars, trucks, motorcycles, trailers, motor homes, boats, etc.

•

Vehicles Sub-total

$0.00

3. Financial assets

List savings and chequing accounts, term deposits, GIC’s, stocks, bonds, Canada Savings Bonds, mutual

•

funds, insurance policies (indicate beneficiaries), accounts receivable, etc.

Record account number and name of institution where accounts are held.

•

Financial assets Sub-total

$0.00

4. Pensions and RRSP’s

Record name of institution where accounts are held, name and address of pension plan and pension details.

•

Pensions and RRSP’s Sub-total

$0.00

5. Business Interests

List any interest you hold, directly or indirectly, in any unincorporated business, including partnerships, trusts

•

and joint ventures.

List any interests you hold in incorporated businesses.

•

Record the name and address of the company.

•

Business interests Sub-total

$0.00

6. Other

Include precious metals, collections, works of art and any jewellery or household items of extraordinary value.

•

Include location of safety deposit boxes.

•

Other Sub-total

$0.00

TOTAL

$0.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12