Form F8 - Financial Statement - Supreme Court Of British Columbia Page 5

ADVERTISEMENT

Page 5

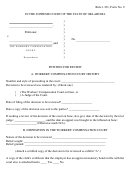

Form F8 – Financial Statement

SCHEDULE A – OTHER INCOME

LINE OTHER SOURCES OF INCOME

1

Self employment income:

Gross =

Net =

+

Note: Provide financial statements of the business, including any statement of business activities filed

as part of your income tax return

2

Other employment income

+

3

Net partnership income: limited or non-active partners only

+

4

Rental income:

Gross =

Net = +

5

Total amount of dividends from Taxable Canadian Corporations

+

6

Total capital gains

minus total capital losses

-

= +

$0.00

7

Spousal support from another relationship or marriage

+

8

Registered retirement savings plan income

+

9

Net federal supplements

+

10

Any other income

+

11

Total of lines 1 through 10 =

$0.00

SCHEDULE B – ADJUSTMENTS TO INCOME

LINE DEDUCTIONS

1

Employment expenses, other than union or professional dues, claimed under

Schedule III of the Child Support Guidelines

(list)

Total

-

$0.00

2

Actual business investment losses during the year

-

3

Carrying charges and interest expenses paid and deductible under the Income

Tax Act (Canada):

(list)

Total

-

$0.00

4

Prior period earnings

minus reserves

-

=

-

$0.00

5

Portion of partnership and sole proprietorship income required to be reinvested

-

ADDITIONS

6

Capital cost allowance for real property

+

7

Employee stock options in Canadian-controlled private corporations exercised:

value of shares when options exercised

minus amount paid for shares

-

minus amount paid to acquire option

-

= +

$0.00

8

Total adjustments

$0.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12