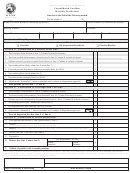

Enter the correct amount of gallons on this page.

A

B

C

D

From

Gasoline/Aviation

K-1/K-2

All Other

Totals

Section A: Receipts

Schedule

Gasoline/Gasohol

Kerosene

Products

1 Gallons received, gasoline tax or inspection fee paid

1A

2 Gallons received from licensed distributors or oil inspection distributors, tax

unpaid

2

3 Gallons of non-taxable fuel received and sold or used for a taxable purpose

2K

4 Gallons received from licensed distributors on exchange agreements, tax unpaid

2X

5 Gallons imported directly to customer

3

6 Gallons imported into own storage

4

7 Diversions into Indiana

11

8 Total receipts - add Lines 1-7, carry total (Column D) to Section 2, Line 1

9 Total receipts - add Lines 1-7, carry total (Column D) to Section 3, Line 1

A

B

C

D

From

Gasoline/Aviation

K-1/K-2

All Other

Totals

Section B: Disbursements

Schedule

Gasoline/Gasohol

Kerosene

Products

1 Gallons delivered, tax collected

5

2 Diversion out of Indiana

11

3 Gallons sold to licensed distributors, tax not collected

6D

4 Gallons disbursed on exchange

6X

5 Gallons exported (must be filed in duplicate)

7

6 Gallons delivered to U.S. Government - tax exempt

8

7 Gallons delivered to licensed marina fuel dealers

10A

8 Gallons delivered to licensed aviation fuel dealers

10B

9 Miscellaneous deduction - theft/loss

E-1

9a Miscellaneous deduction - off road, other

E-1

10 Total non-taxable disbursements - add Lines 2-9a, carry total to Section 2, Line 2

11 Total non-taxable disbursements - add Lines 2-6, carry total to Section 3, Line 2

1

1 2

2 3

3 4

4 5

5