Instructions for Completing Consolidated Gasoline Monthly Tax Return (MF-360)

Who should file this return?

Line 4: Enter the total billed taxable gallons (Line 1 minus Line 2

minus Line 3).

A gasoline tax is imposed on every gallon of gasoline received

in Indiana less those deductions provided by law. Each person

Line 5: Licensed Gasoline Distributors who file their returns

who holds a valid Indiana Gasoline Distributor’s License must file

timely and remit all amounts of tax due timely are entitled to claim

Form MF-360, Consolidated Gasoline Monthly Tax Return and

a gallonage allowance of one and six-tenths percent (1.6%) of

schedules with the Indiana Department of Revenue. Distributors

the gallons of gasoline received, less deductions. The deduction

are required to indicate on such returns all gasoline received as

will not be allowed if a monthly return and schedules and/or tax

well as support all deductions claimed, during the month for which

remittance is filed after the due date of the return.

the return is filed. A return must be filed each month, even if the

distributor has no activity to report on the return.

Line 6: Enter the total billed taxable gallons (Line 4 minus Line 5).

When is the return/payment due?

Line 7: Enter the tax due (multiply Line 6 by the applicable rate

below).

Form MF-360 and schedules must be filed on or before the

twentieth (20th) day of the month immediately following the month

Gasoline Tax Rate Table

for which the report is being filed. If the 20th day of the month

Prior to July 1, 2017 ................................$0.18 per gallon

falls on a Saturday, Sunday or a state or national legal holiday,

For periods on or after July 1, 2017 ........$0.28 per gallon

the due date of the return is the next succeeding day that is not a

Saturday, Sunday or such holiday. To be considered timely filed by

Line 8: Enter any adjustments not accommodated elsewhere on

the department, the return must be postmarked no later than the

this return. For adjustments taken on this line, Schedule E-1 must

due date of the return.

be attached. Failure to complete and attach Schedule E-1 will

result in your adjustment being disallowed. If line 8 is a negative

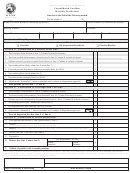

How do I complete the MF-360?

amount, be certain that you circle the “-” sign in the box to the left

of your Line 8 entry.

Complete Form MF-360 as instructed below:

Line 9: Enter the total gasoline tax due (Line 7 plus or minus Line

Step 1: Indicate the reporting period for which you are filing. Enter

8).

your identifying information as it is reflected on your Indiana Fuel

Tax License.

Section 3

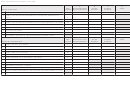

Step 2: Complete all receipt and disbursement schedules by

Calculation Of Oil Inspection Fees Due

entering the totals in Sections A & B on the reverse side of the

Line 1: Enter the total amount of gasoline, kerosene and other

MF-360. Detailed instructions for reporting fuel transactions on the

products purchased, acquired or imported during the month (from

corresponding receipt and disbursements schedules are found in

Section A, Line 9, Column D).

the instructions for each schedule.

Line 2: Enter the total of non-taxable disbursements made during

the month (from Section B, Line 11, Column D).

Step 3: Carry specific line totals from Section A and B, on the

back of the MF-360, to the appropriate sections on the front of the

Line 3: Enter the total gallons received, oil inspection fee paid

MF-360.

(from Section A, Line 1, Column D).

Indicate the reporting period for which you are filing. Enter your

Line 4: Enter the total billed taxable gallons (Line 1 minus Line 2

identifying information as it is reflected on your Indiana Fuel Tax

minus Line 3).

License.

Section 1

Line 5: Enter the tax due (multiply Line 4 by $.01).

Place an “X” in the box for each license type for which your return

Line 6: Enter any adjustments not accommodated elsewhere on

is being filed. Example: If you are a licensed Gasoline Distributor

this return. For adjustments taken on this line, Schedule E-1 must

you will place an “X” in that box.

be attached. Failure to complete and attach Schedule E-1 will

result in your adjustment being disallowed. If Line 6 is a negative

Section 2

amount, be certain that you circle the “-” sign in the box to the left

of your Line 6 entry.

Calculation of Gasoline Taxes Due

Line 1: Enter the total amount of gasoline purchased, acquired or

Line 7: Enter the total oil inspection fee due (Line 5 plus or minus

imported during the month from Section A, Line 8 Column D

Line 6).

Line 2: Enter the total of non-taxable disbursements made during

the month from Section B, Line 10, Column D on back of return.

Line 3: Enter the total gallons of gasoline received, gasoline tax

paid From Section A, Line 1, Column A.

1

1 2

2 3

3 4

4 5

5