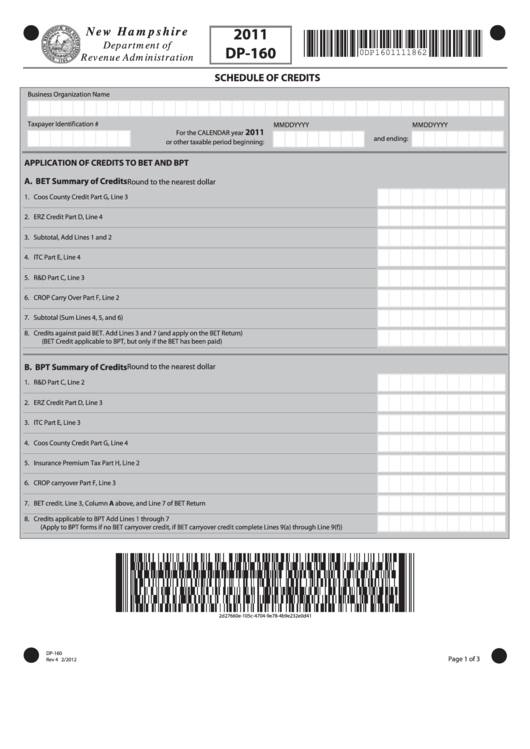

Form Dp-160 - Schedule Of Credits - New Hampshire Department Of Revenue Administration - 2011

ADVERTISEMENT

New Hampshire

2011

Department of

DP-160

0DP1601111862

Revenue Administration

SCHEDULE OF CREDITS

Business Organization Name

Taxpayer Identification #

MMDDYYYY

MMDDYYYY

2011

For the CALENDAR year

and ending:

or other taxable period beginning:

APPLICATION OF CREDITS TO BET AND BPT

A. BET Summary of Credits

Round to the nearest dollar

1. Coos County Credit Part G, Line 3

2. ERZ Credit Part D, Line 4

3. Subtotal, Add Lines 1 and 2

4. ITC Part E, Line 4

5. R&D Part C, Line 3

6. CROP Carry Over Part F, Line 2

7. Subtotal (Sum Lines 4, 5, and 6)

8. Credits against paid BET. Add Lines 3 and 7 (and apply on the BET Return)

(BET Credit applicable to BPT, but only if the BET has been paid)

B. BPT Summary of Credits

Round to the nearest dollar

1. R&D Part C, Line 2

2. ERZ Credit Part D, Line 3

3. ITC Part E, Line 3

4. Coos County Credit Part G, Line 4

5. Insurance Premium Tax Part H, Line 2

6. CROP carryover Part F, Line 3

7. BET credit. Line 3, Column A above, and Line 7 of BET Return

8. Credits applicable to BPT Add Lines 1 through 7

(Apply to BPT forms if no BET carryover credit, if BET carryover credit complete Lines 9(a) through Line 9(f))

2d27660e-105c-4704-9e78-4b9e232e0d41

DP-160

Page 1 of 3

Rev 4 2/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3