Tod Transfer Form

Download a blank fillable Tod Transfer Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Tod Transfer Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

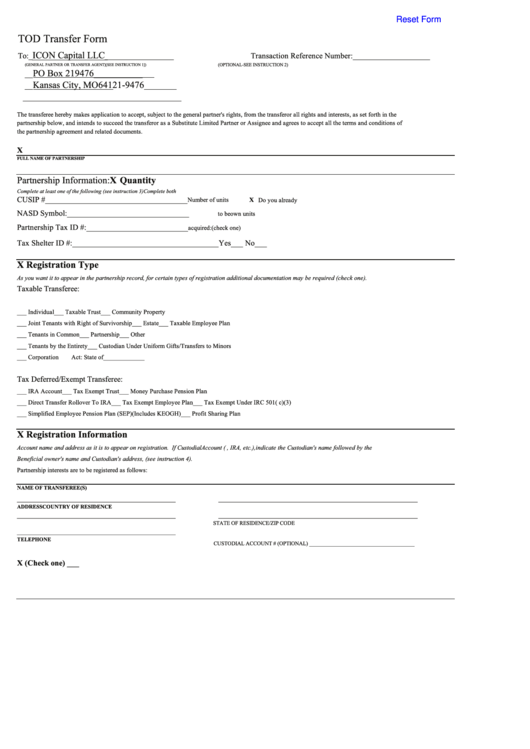

TOD Transfer Form

ICON Capital LLC

To:_

_________________

Transaction Reference Number:

___________________

(GENERAL PARTNER OR TRANSFER AGENT)[SEE INSTRUCTION 1])

(OPTIONAL-SEE INSTRUCTION 2)

PO Box 219476

__

____________

Kansas City, MO 64121-9476

__

________

_______________________________________

The transferee hereby makes application to accept, subject to the general partner's rights, from the transferor all rights and interests, as set forth in the

partnership below, and intends to succeed the transferor as a Substitute Limited Partner or Assignee and agrees to accept all the terms and conditions of

the partnership agreement and related documents.

X

FULL NAME OF PARTNERSHIP

Partnership Information:

X Quantity

Complete at least one of the following (see instruction 3)

Complete both

CUSIP #___________________________________

Number of units

X Do you already

NASD Symbol:______________________________

to be

own units

Partnership Tax ID #:_________________________

acquired:

(check one)

Tax Shelter ID #:____________________________

________

Yes___ No___

X Registration Type

As you want it to appear in the partnership record, for certain types of registration additional documentation may be required (check one).

Taxable Transferee:

___ Individual

___ Taxable Trust

___ Community Property

___ Joint Tenants with Right of Survivorship

___ Estate

___ Taxable Employee Plan

___ Tenants in Common

___ Partnership

___ Other

___ Tenants by the Entirety

___ Custodian Under Uniform Gifts/Transfers to Minors

___ Corporation

Act: State of_____________

Tax Deferred/Exempt Transferee:

___ IRA Account

___ Tax Exempt Trust

___ Money Purchase Pension Plan

___ Direct Transfer Rollover To IRA

___ Tax Exempt Employee Plan

___ Tax Exempt Under IRC 501( c)(3)

___ Simplified Employee Pension Plan (SEP)(Includes KEOGH)

___ Profit Sharing Plan

X Registration Information

Account name and address as it is to appear on registration. If Custodial Account (i.e., IRA, etc.), indicate the Custodian's name followed by the

Beneficial owner's name and Custodian's address, (see instruction 4).

Partnership interests are to be registered as follows:

NAME OF TRANSFEREE(S)

_______________________________________

_________________________________________________

ADDRESS

COUNTRY OF RESIDENCE

_______________________________________

_________________________________________________

STATE OF RESIDENCE/ZIP CODE

_______________________________________

TELEPHONE

CUSTODIAL ACCOUNT # (OPTIONAL) _____________________________________

X (Check one) ___ U.S. Citizen ___ U.S. Resident Alien

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2