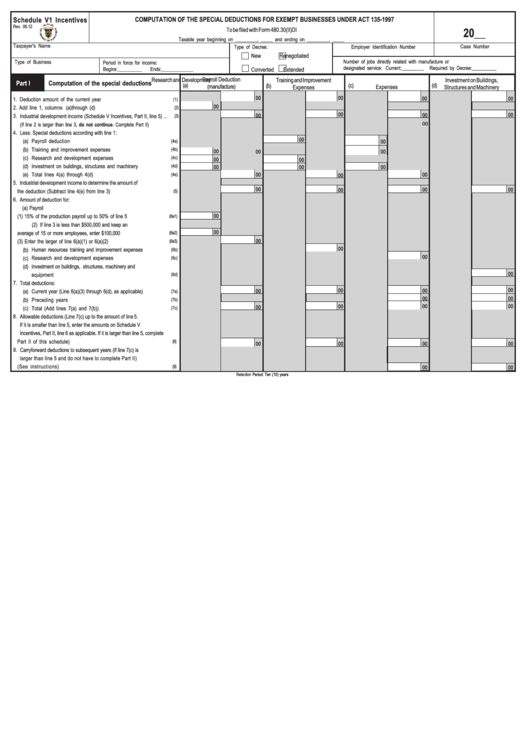

Schedule V1 Incentives - Computation Of The Special Deductions For Exempt Businesses - 2012

ADVERTISEMENT

Schedule V1 Incentives

COMPUTATION OF THE SPECIAL DEDUCTIONS FOR EXEMPT BUSINESSES UNDER ACT 135-1997

Rev. 06.12

20__

To be filed with Form 480.30(II)DI

Taxable year beginning on _________, _____ and ending on _________, _____

Taxpayer's Name

Case Number

Type of Decree:

Employer Identification Number

New

Renegotiated

Number of jobs directly related with manufacture or

Type of Business

Period in force for income:

designated service: Current:_________

Required by Decree:__________

Begins:__________

Ends:_____________

Converted

Extended

Payroll Deduction

Research and Development

Training and Improvement

Investment on Buildings,

Part I

Computation of the special deductions

(a)

(b)

(c)

(d)

(manufacture)

Expenses

Expenses

Structures and Machinery

00

00

00

00

1.

Deduction amount of the current year ................................................

(1)

00

2.

Add line 1, columns (a) through (d) ................................................

(2)

00

00

00

3.

Industrial development income (Schedule V Incentives, Part II, line 5) ...

00

(3)

00

(If line 2 is larger than line 3, do not continue. Complete Part II)

4.

Less: Special deductions according with line 1:

00

(a)

Payroll deduction ...................................................................

(4a)

00

(b)

Training and improvement expenses ........................................

(4b)

00

00

00

(c)

Research and development expenses ......................................

(4c)

00

00

(d)

Investment on buildings, structures and machinery .....................

(4d)

00

00

00

Total lines 4(a) through 4(d) .....................................................

(e)

(4e)

00

00

00

5.

Industrial development income to determine the amount of

00

00

00

00

the deduction (Subtract line 4(e) from line 3) ........................................

(5)

6.

Amount of deduction for:

(a) Payroll

00

(1) 15% of the production payroll up to 50% of line 5 ..................

(6a1)

(2) If line 3 is less than $500,000 and keep an

00

average of 15 or more employees, enter $100,000 ..................

(6a2)

(3) Enter the larger of line 6(a)(1) or 6(a)(2) ................................

00

(6a3)

00

(b)

Human resources training and improvement expenses ..................

(6b)

00

(c)

Research and development expenses ......................................

(6c)

(d)

Investment on buildings, structures, machinery and

00

equipment

.........................................................................................

(6d)

7.

Total deductions:

00

00

00

00

(a)

Current year (Line 6(a)(3) through 6(d), as applicable) .................

(7a)

00

00

(b)

Preceding years ...................................................................

(7b)

00

00

00

00

(c)

Total (Add lines 7(a) and 7(b)) .................................................

(7c)

8.

Allowable deductions (Line 7(c) up to the amount of line 5.

If it is smaller than line 5, enter the amounts on Schedule V

Incentives, Part II, line 6 as applicable. If it is larger than line 5, complete

Part II of this schedule) ..................................................................

(8)

00

00

00

00

9.

Carryforward deductions to subsequent years (If line 7(c) is

larger than line 5 and do not have to complete Part II)

(See instructions)..................................................................

(9)

00

00

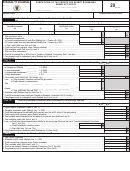

Retention

Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2