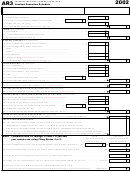

Form Ir - Declaration Of Estimated Tax - Village Of West Union - 2002 Page 2

ADVERTISEMENT

WEST UNION INCOME FORM IR

SIDE TWO

15. TAXABLE INCOME NOT REPORTED UPON A W-2 FORM (ATTACH COPY APPROPRIATE FEDERAL INCOME REPORTING FORM(S) $__________________

(NOTE: Income reported on 1099-INT, 1099-R, 1099-D, 1099-G & W2P are not taxable)

16. NET PR OFIT(S) (LOSS) FROM PROFESSION AND/OR BUSINESS OPERATION(S) (ATTACH FEDERAL SCHEDULE C)…………………$___________________

17. NET PROFIT(S) (LOSS) FROM RENTAL PROPERTY AND/OR PARTNERSHIP(S) (ATTACH FEDERAL SCHEDULE E)……………………$___________________

18. TOTAL NET PROFIT( S) (LOSSES) FROM BUSINESS ACTIVITIES (LINE 16 PLUS 17)………………………………………………...………….$___________________

19. BUSINESS LOSS TOTAL FROM PREVIOUS TAX RETURNS (MAY BE CARRIED FORWARD FOR A

MAXIMUM PERIOD OF THREE (3) YEARS)………………………......………………………………………………..….$___________________

20. SUBTRACT LINE 19 FROM 18. IF RESULT IS A LOSS, LIST ON THIS LINE FOR FUTURE CARRY FORWARD….$___________________

(Note: losses from business activities MAY NOT be used as deduction from wage/salary type earnings)

21. IF THE CALCULATION OF LINE 20 (LINE 18 MINUS LINE 19) RESULTS IN NET GAIN LIST THE AMOUNT ON THIS LINE………………$___________________

22. DEDUCTIONS AND NON -TAXABLE INCOME SEE INSTRUCTIONS FOR DETAIL

A. ………………………………………………………………………………………………………………………….. $___________________

B. …………………………………………………………………………………………………………………………… $___________________

C. TOTAL DEDUCTIONS AND/OR NON -TAXABLE INCOME (LINE 22A plus LINE 22B)………………………………………………..$___________________

23. TOTAL OTHER TAXABLE INCOME OR DEDUCTIONS LINE 15 PLUS LINE 18 PLUS LINE 21 MINUS LINE 22C

(ALSO ENTER THIS TOTAL ON LINE 2)………………………………………………………………………………………………………..$___________________

__________________________________________________________________________________________________________________________________________________

FILING INSTRUCTIONS

TAXABLE INCOME is all gross wages, salaries and other compensation (Form 1099 MISC) paid by an employer or employers before deductions, and/or the net

profits from the operation of a business, profession or other enterprise or activity, sick pay, vacation pay, supplement unemployment benefits paid by the employer

(SUB PAY), insurance premium payments by employer included on the W-2, and deferred compensation are also taxable for city purposes.

LINE # 1 is to be the grand total of all gross compensation from all W-2 forms for the tax year. Each W-2 form should be examined in all wage areas: Federal, State,

Social Security, Medicare and Local for the highest wages earned. Income taxable by the city may differ from income taxable by IRS. BE SURE TO ATTACH ALL W-

2 and 1099-MISC FORMS. WHEN FILING. If you wish the forms returned, please advise - enclose self -addressed, stamped envelope.

LINE #2. All other taxable income reported on lines 23. Business losses may not be used to offset wages.

LINE #3. Total lines 1 and 2.

LINE #4. Multiply line 3 by .005.

LINE #5A is to be used for reporting taxes withheld by your employer for the Village of WEST UNION.

5B Total 2002 estimated tax paid.

5C Estimated tax paid to another city or village (not to exceed 1/2% (.005) PER W-2

5D Overpayments of 2002 tax applied to the 2003 estimated tax.

5E Total lines 5a through 5d.

LINE #6 TAX DUE: If by making this calculation the sum on this line is five dollars ($5.00) or more, full payment must be received on or before the due date. Any tax

remaining unpaid after the date due is subject to interest and penalty charges as prescribed by ordinance.

LINE #7 Overpayment of tax (if any), if you wish a tax refund or credited to next year estimate.

LINES #8 THRU #12 are required to be completed. The total estimated tax due must be paid at the time of filing – No later than April 30th.

LINE #15 is for reporting such items as non-employee income listed on a 1099 form, sales commissions , fees, and other taxable income.

LINES #16 thru #18 are for reporting profits or losses from the business activities listed. BUSINESS LOSSES MAY NOT BE USED AS A DEDUCTION AGAINST

WAGE EARNINGS but may be carried forward and used to offset future business profits either until exhausted or in no event beyond three taxable years.

READABLE COPIES OF ALL SUPPORTING FORMS AND SCHEDULES MUST BE ATTACHED BEFORE ANY ITEM WILL BE CONSIDERED AS APPLICABLE

TO THIS TAX RETURN.

LINE #22 DEDUCTIONS AND NON -TAXABLE INCOME: This line is for use by those claiming employer business expense as a deduction from earnings. This

deduction will be permitted ONLY when accompanied by a copy of a properly completed Federal 2106 Expense form. A copy of the taxpayers 1040 Federal tax

return may be requested.

Contributions made to an Individual Retirement Account (IRA), Simplified Employee Pension (SEP), KEOGH, Retirement Plan or Deferred Income are NOT

ALLOWED DEDUCTIONS ON A CITY RETURN. City tax is due and payable in the year of the cont ribution BUT the benefit, when received is not taxable.

NOTE: UNLESS ACCOMPANIED BY PAYMENT OF THE BALANCE OF TAX DECLARED DUE (LINE 6) AND AT LEAST 1/4 OF THE

ESTIMATED TAX (LINE 10), THIS FORM IS NOT A LEGAL FINAL RETURN OR DECLARATION.

NOTICE: TO ALL WEST UNION TAXPAYERS: LATE PAYMENT OF TAXES DUE ARE SUBJECT TO PENALTY AND INTEREST CHARGES.

TAX RETURN FILING AND PAYMENT CALENDAR

ON OR BEFORE

ON OR BEFORE

4/30/02

ON OR BEFORE

ON OR BEFORE

ON OR BEFORE

4/30/04

FILE 2002 TAX RETURN,

7/31/03

10/31/03

1/31/04

FILE 2003 TAX RETURN

nd

rd

th

PAY ANY TAX DUE PLUS

PAY 2

QUARTER

PAY 3

QUARTER

PAY 4

QUARTER

PAY ANY TAX DUE PLUS

1/4 2003 TAX ESTIMATE

2003 TAX EXTIMATE

2003 TAX ESTIMATE

2003 TAX ESTIMATE

1/4 2004 TAX ESTIMATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2