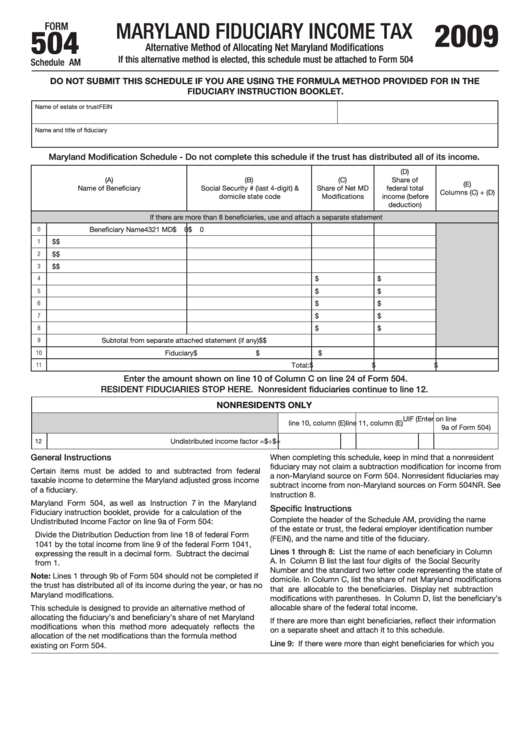

2009

MARYLAND FIDUCIARY INCOME TAX

FORM

504

Alternative Method of Allocating Net Maryland Modifications

If this alternative method is elected, this schedule must be attached to Form 504

Schedule AM

DO NOT SUBMIT THIS SCHEDULE IF YOU ARE USING THE FORMULA METHOD PROVIDED FOR IN THE

FIDUCIARY INSTRUCTION BOOKLET.

Name of estate or trust

FEIN

Name and title of fiduciary

Maryland Modification Schedule - Do not complete this schedule if the trust has distributed all of its income.

(D)

(A)

(B)

(C)

Share of

(E)

Name of Beneficiary

Social Security # (last 4-digit) &

Share of Net MD

federal total

Columns (C) + (D)

domicile state code

Modifications

income (before

deduction)

If there are more than 8 beneficiaries, use and attach a separate statement

Beneficiary Name

4321 MD

$

0

$

0

0

1

$

$

2

$

$

3

$

$

$

$

4

$

$

5

$

$

6

$

$

7

$

$

8

Subtotal from separate attached statement (if any)

$

$

9

10

Fiduciary

$

$

$

11

Total: $

$

$

Enter the amount shown on line 10 of Column C on line 24 of Form 504.

RESIDENT FIDUCIARIES STOP HERE. Nonresident fiduciaries continue to line 12.

NONRESIDENTS ONLY

UIF (Enter on line

line 10, column (E)

line 11, column (E)

9a of Form 504)

Undistributed income factor =

$

÷

$

=

12

General Instructions

When completing this schedule, keep in mind that a nonresident

fiduciary may not claim a subtraction modification for income from

Certain items must be added to and subtracted from federal

a non-Maryland source on Form 504. Nonresident fiduciaries may

taxable income to determine the Maryland adjusted gross income

subtract income from non-Maryland sources on Form 504NR. See

of a fiduciary.

Instruction 8.

Maryland Form 504, as well as Instruction 7 in the Maryland

Specific Instructions

Fiduciary instruction booklet, provide for a calculation of the

Complete the header of the Schedule AM, providing the name

Undistributed Income Factor on line 9a of Form 504:

of the estate or trust, the federal employer identification number

Divide the Distribution Deduction from line 18 of federal Form

(FEIN), and the name and title of the fiduciary.

1041 by the total income from line 9 of the federal Form 1041,

Lines 1 through 8: List the name of each beneficiary in Column

expressing the result in a decimal form. Subtract the decimal

A. In Column B list the last four digits of the Social Security

from 1.

Number and the standard two letter code representing the state of

Note: Lines 1 through 9b of Form 504 should not be completed if

domicile. In Column C, list the share of net Maryland modifications

the trust has distributed all of its income during the year, or has no

that are allocable to the beneficiaries. Display net subtraction

Maryland modifications.

modifications with parentheses. In Column D, list the beneficiary’s

allocable share of the federal total income.

This schedule is designed to provide an alternative method of

allocating the fiduciary’s and beneficiary’s share of net Maryland

If there are more than eight beneficiaries, reflect their information

modifications when this method more adequately reflects the

on a separate sheet and attach it to this schedule.

allocation of the net modifications than the formula method

Line 9: If there were more than eight beneficiaries for which you

existing on Form 504.

1

1