Publication 972 Draft - Child Tax Credit - 2015 Page 4

ADVERTISEMENT

Keep for Your Records

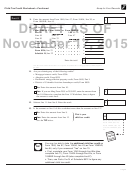

Child Tax Credit Worksheet—Continued

Part 2

9.

Enter the amount from Form 1040, line 47; Form 1040A, line 30; or

9

DRAFT AS OF

Form 1040NR, line 45.

10.

Add the following amounts from:

Form 1040 or Form 1040A or Form 1040NR

Line 48

Line 46

+

Line 49

Line 31

Line 47

+

November 17, 2015

Line 50

Line 33

+

Line 51

Line 34

Line 48

+

Form 5695, line 30*

+

Form 8910, line 15

+

Form 8936, line 23

+

Schedule R, line 22

+

10

Enter the total.

*See the Form 5695 instructions to see if line 30 (nonbusiness energy property credit) applies

for 2015.

11.

Are you claiming any of the following credits?

• Mortgage interest credit, Form 8396.

• Adoption credit, Form 8839.

• Residential energy ef cient property credit, Form 5695, Part I.

• District of Columbia rst-time homebuyer credit, Form 8859.

No. Enter the amount from line 10.

11

Yes. If you are ling Form 2555 or 2555-EZ, enter the amount from

line 10. Otherwise, complete the Line 11 Worksheet, later, to gure

the amount to enter here.

12

12.

Subtract line 11 from line 9. Enter the result.

13.

Is the amount on line 8 of this worksheet more than the amount on line 12?

No. Enter the amount from line 8.

This is your

13

child tax credit.

Yes. Enter the amount from line 12.

See the

TIP

below.

Enter this amount on

Form 1040, line 52;

Form 1040A, line 35;

or Form 1040NR, line

49.

You may be able to take the additional child tax credit on

Form 1040, line 67; Form 1040A, line 43; or Form 1040NR,

TIP

line 64, only if you answered “Yes” on line 13.

• First, complete your Form 1040 through line 66a (also

complete line 71), Form 1040A through line 42a, or Form

1040NR through line 63 (also complete line 67).

• Then, use Parts II

IV of Schedule 8812 to gure any

additional child tax credit.

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4