Instructions For Completing Form 3581 - Michigan Historic Preservation Tax Credit

ADVERTISEMENT

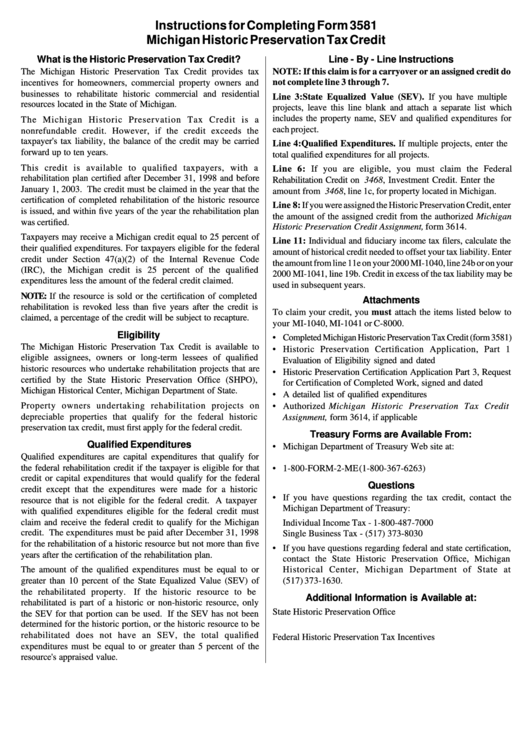

Instructions for Completing Form 3581

Michigan Historic Preservation Tax Credit

What is the Historic Preservation Tax Credit?

Line - By - Line Instructions

The Michigan Historic Preservation Tax Credit provides tax

NOTE: If this claim is for a carryover or an assigned credit do

not complete line 3 through 7.

incentives for homeowners, commercial property owners and

businesses to rehabilitate historic commercial and residential

Line 3: State Equalized Value (SEV). If you have multiple

resources located in the State of Michigan.

projects, leave this line blank and attach a separate list which

includes the property name, SEV and qualified expenditures for

The Michigan Historic Preservation Tax Credit is a

each project.

nonrefundable credit. However, if the credit exceeds the

taxpayer's tax liability, the balance of the credit may be carried

Line 4: Qualified Expenditures. If multiple projects, enter the

forward up to ten years.

total qualified expenditures for all projects.

This credit is available to qualified taxpayers, with a

Line 6: If you are eligible, you must claim the Federal

rehabilitation plan certified after December 31, 1998 and before

Rehabilitation Credit on U.S. 3468, Investment Credit. Enter the

January 1, 2003. The credit must be claimed in the year that the

amount from U.S. 3468, line 1c, for property located in Michigan.

certification of completed rehabilitation of the historic resource

Line 8: If you were assigned the Historic Preservation Credit, enter

is issued, and within five years of the year the rehabilitation plan

the amount of the assigned credit from the authorized Michigan

was certified.

Historic Preservation Credit Assignment, form 3614.

Taxpayers may receive a Michigan credit equal to 25 percent of

Line 11: Individual and fiduciary income tax filers, calculate the

their qualified expenditures. For taxpayers eligible for the federal

amount of historical credit needed to offset your tax liability. Enter

credit under Section 47(a)(2) of the Internal Revenue Code

the amount from line 11e on your 2000 MI-1040, line 24b or on your

(IRC), the Michigan credit is 25 percent of the qualified

2000 MI-1041, line 19b. Credit in excess of the tax liability may be

expenditures less the amount of the federal credit claimed.

used in subsequent years.

NOTE: If the resource is sold or the certification of completed

Attachments

rehabilitation is revoked less than five years after the credit is

To claim your credit, you must attach the items listed below to

claimed, a percentage of the credit will be subject to recapture.

your MI-1040, MI-1041 or C-8000.

Eligibility

• Completed Michigan Historic Preservation Tax Credit (form 3581)

The Michigan Historic Preservation Tax Credit is available to

• Historic Preservation Certification Application, Part 1

eligible assignees, owners or long-term lessees of qualified

Evaluation of Eligibility signed and dated

historic resources who undertake rehabilitation projects that are

• Historic Preservation Certification Application Part 3, Request

certified by the State Historic Preservation Office (SHPO),

for Certification of Completed Work, signed and dated

Michigan Historical Center, Michigan Department of State.

• A detailed list of qualified expenditures

Property owners undertaking rehabilitation projects on

• Authorized Michigan Historic Preservation Tax Credit

depreciable properties that qualify for the federal historic

Assignment, form 3614, if applicable

preservation tax credit, must first apply for the federal credit.

Treasury Forms are Available From:

Qualified Expenditures

• Michigan Department of Treasury Web site at:

Qualified expenditures are capital expenditures that qualify for

the federal rehabilitation credit if the taxpayer is eligible for that

• 1-800-FORM-2-ME (1-800-367-6263)

credit or capital expenditures that would qualify for the federal

Questions

credit except that the expenditures were made for a historic

• If you have questions regarding the tax credit, contact the

resource that is not eligible for the federal credit. A taxpayer

Michigan Department of Treasury:

with qualified expenditures eligible for the federal credit must

claim and receive the federal credit to qualify for the Michigan

Individual Income Tax - 1-800-487-7000

credit. The expenditures must be paid after December 31, 1998

Single Business Tax - (517) 373-8030

for the rehabilitation of a historic resource but not more than five

• If you have questions regarding federal and state certification,

years after the certification of the rehabilitation plan.

contact the State Historic Preservation Office, Michigan

The amount of the qualified expenditures must be equal to or

Historical Center, Michigan Department of State at

greater than 10 percent of the State Equalized Value (SEV) of

(517) 373-1630.

the rehabilitated property.

If the historic resource to be

Additional Information is Available at:

rehabilitated is part of a historic or non-historic resource, only

State Historic Preservation Office

the SEV for that portion can be used. If the SEV has not been

determined for the historic portion, or the historic resource to be

rehabilitated does not have an SEV, the total qualified

Federal Historic Preservation Tax Incentives

expenditures must be equal to or greater than 5 percent of the

www2.cr.nps.gov/

resource's appraised value.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2