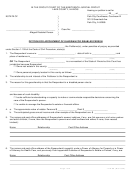

Commercial / Industrial Real Estate Assessment Appeal For Tax Year 2004 - Lake County, Illinois Page 2

ADVERTISEMENT

Board of Review

Jay Weaver

, C.I.A.O.

Chairman

Tom Cooprider

, C.I.A.O.

Linda M. Barbera-Stein

Members

Martin P. Paulson,

C.I.A.O./I

Clerk

th

18 North County Street - 7

Floor

Waukegan, Illinois 60085-4335

Phone (847) 377-2100

It is strongly recommended that the taxpayer discuss their assessment with the Township Assessor prior to

the filing of an appeal with the Board of Review. Many times the reason for the assessment can be made clear

and the need for filing an appeal eliminated. If, after talking with the Township Assessor, the taxpayer still wishes

to pursue an appeal, he/she should familiarize themselves with the 2004 Rules Governing Hearings Before the

Board of Review of Lake County below. It should be noted that the time period for filing is not waived in any way

to allow for discussing the assessment with the Assessor. The Board of Review shall determine the correct

assessment prior to state equalization of any parcel of real property which is the subject of an appeal based on

facts, evidence, exhibits and briefs submitted to or elicited by the Board from the appellant, the Assessor, and/or

other interested parties.

2004 RULES GOVERNING HEARINGS BEFORE THE BOARD OF REVIEW OF LAKE COUNTY

I.

HEARING LOCATION

Hearings of the Board of Review of Lake County will be held in the Board office on the 7th floor in the

Lake County Administration Building in the City of Waukegan, Illinois. Hearings may be held in other parts

of the county at the discretion of the Board.

II.

HEARING TIME

The Board will convene as necessary to conduct business. Hearings are generally scheduled throughout the

day, Monday through Friday. Some Saturday hearings may be required based on the volume of appeals

filed.

III.

TIME FOR FILING APPEALS

All appeals must be filed with the Clerk of the Board of Review on or before the Tenth Day of September,

2004; or if the assessment books for a township are not delivered to the Board until after August 10, 2004;

then on or before thirty (30) days after the newspaper publication of said township assessment roll.

Appeals must be filed on or before the closing date for each township. Mailings postmarked by the U.S.

Postal Service are deemed filed on the date postmarked. Metered mail must also bear the official U.S.

Postal Service date stamp if it arrives after the final filing date. All other mailings and hand deliveries are

deemed filed on the date received in the Board of Review office.

The Board office is closed on the following holidays:

Memorial Day

Thanksgiving Day

Independence Day (July 5)

The Friday After Thanksgiving

Labor Day

Christmas Day (Dec. 24)

Election Day

New Year’s Day

(1)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5