Commercial / Industrial Real Estate Assessment Appeal For Tax Year 2004 - Lake County, Illinois Page 5

ADVERTISEMENT

UNIFORMITY APPEALS

Evidence must be presented to substantiate a contention of non-uniformity. A minimum of three

comparables from the immediate area of the subject property should be included in the appeal. In general,

these comparables should be located near the subject property and in the same subdivision or neighborhood.

The comparables should be similar in size, age, construction and style. For residential appeals, the Board

recommends that appellants complete a residential comparable grid in its entirety.

INCOME PROPERTY

The taxpayer should furnish copies of the most recent three-year income and expense statements along with

occupancy information. This information should be submitted at the time of filing.

VI.

FINDINGS

In most instances, the appellant will be notified at the end of the hearing of the Board’s decision and the

reason for that decision. There will be some instances where the Board will need to deliberate further on a

case, causing a decision to be rendered at a later date. After all hearings in a township are completed,

official findings for each case will be mailed to all appellants. No written decisions will be released prior to

this time.

VII.

APPLICATIONS FOR PROPERTY TAX EXEMPTION

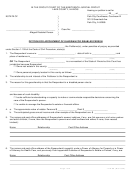

Applications for Property Tax Exemption must be filed in duplicate on the form provided by the Board of

Review office no later than December 1, 2004. An additional parsonage form will be supplied in appropriate

cases.

In cases where the exemption requested would remove a value of $100,000 or more, it is the responsibility

of the owner, agent or attorney to notify the municipality, school districts and community college district in

which the property is situated. A form certifying that this notice has been given is available at the Board of

Review office, should you wish to utilize it. Applications requiring certification will not be processed or set

for hearing until such certification has been received and made a part of the file.

A taxing body wishing to intervene in an exemption matter before the Board must file a Request to

Intervene with the Board of Review at least five days in advance of the scheduled hearing. This form is

available in the Board office and online at

The Board of Review decision is only a recommendation. Exemption decisions are reviewed and finalized

by the Illinois Department of Revenue. Decisions of the Illinois Department of Revenue may be appealed

directly to the Department of Revenue’s Administrative Law Judge.

These Rules as set forth may be amended at any time at the discretion of the Board. BY ORDER OF THE

BOARD OF REVIEW OF LAKE COUNTY, ILLINOIS/APPROVED AND ADOPTED JUNE 1, 2004.

(4)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5