Commercial / Industrial Real Estate Assessment Appeal For Tax Year 2004 - Lake County, Illinois Page 3

ADVERTISEMENT

The Board office is open on the following holidays and final filing dates can and often do occur on these:

M. L. King’s Birthday

Columbus Day

A. Lincoln’s Birthday

Veteran’s Day

Good Friday

PLEASE NOTE THAT LATE POSTMARKS ON APPEAL ENVELOPES DUE TO THESE HOLIDAYS

WILL BE DEEMED A LATE FILING.

IV.

APPEALS

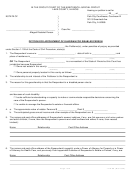

Appeals relating to real estate assessments must be filed on the form provided by the Board of

Review. All applicable items on the appeal form must be completed. The Board of Review office

will not send forms out by Overnight Express, fax machine or any method other than first class mail.

Appeal forms and/or evidence will not be accepted by fax or email. Forms are available over the internet at

General questions can be answered by office staff via telephone or emailed to

this office at BoardofReview@co.lake.il.us.

The second page of the Residential Appeal Form is a Residential Comparison Grid. The Board of Review

feels this is a useful tool for taxpayers to substantiate their claim of over-assessment. Also included is an

instruction sheet to assist in completing the Residential Comparison Grid.

The Board requires written evidence of authority for individuals to represent taxpayers for each applicable

year. Upon request, a form will be mailed to you and it is available on the internet at

If an owner has granted authorization by signing the appeal

form, the authorization form is not necessary.

If an appeal deals with the land and building(s) on one permanent index number as separate issues, they are

nevertheless to be filed on one appeal form. When an appellant states that their appeal is only on the land or

building(s), be advised the Board of Review will make their decision by evaluating the total assessment, not

just that part being objected to.

Failure of the appellant to comply fully with all rules and regulations and/or specific requests of the Board of

Review with regard to their appeal shall be sufficient cause to dismiss the appeal.

There are three options at the bottom of the appeal form regarding how you wish to present your

case to the Board. Please be sure to check the one option that is applicable to your filing.

If you do not check any of these, the Board will assume that you will be making a personal appearance for

your hearing and you will be notified by mail of the designated date and time to appear.

REDUCTIONS OF $100,000 OR MORE IN ASSESSED VALUATION - Pursuant to Chapter 35, Illinois

Compiled Statutes (ILCS), Act 200/§16-55, if an appellant is requesting a reduction in assessed valuation of

$100,000 or more, it is required that the Board notify each respective taxing district. It is therefore required

that appellants supply their requested assessment total in the appropriate space on the appeal form. If this

information is not provided the Board will assume the requested reduction is less than $100,000 and will only

consider a reduction of less than that amount.

A taxing body wishing to intervene in a matter before the Board must file a Request to Intervene with the

Board of Review at least five days in advance of the scheduled hearing. This form is available in the Board

office and online at

(2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5