Rds Motor Fuel Tax Return - Walker County Gasoline - 2010

ADVERTISEMENT

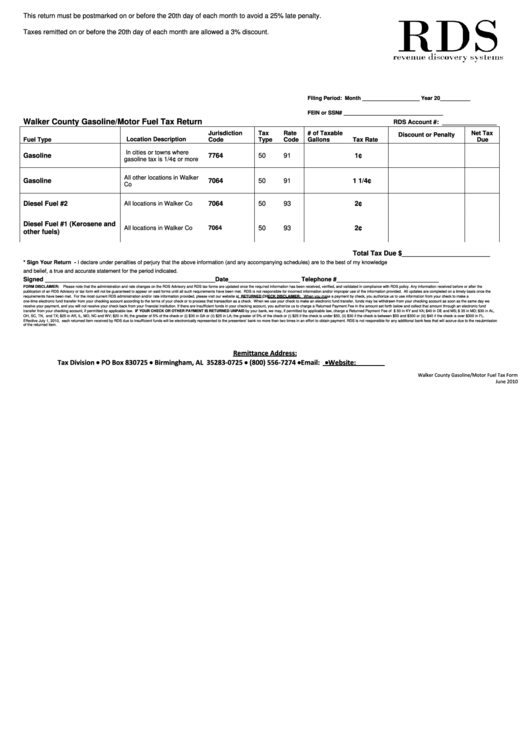

This return must be postmarked on or before the 20th day of each month to avoid a 25% late penalty.

Taxes remitted on or before the 20th day of each month are allowed a 3% discount.

Filing Period: Month ___________________ Year 20__________

FEIN or SSN# _________________________________

Walker County Gasoline/Motor Fuel Tax Return

RDS Account #: ________________

Jurisdiction

Tax

Rate

# of Taxable

Net Tax

Discount or Penalty

Location Description

Fuel Type

Code

Type

Code

Gallons

Tax Rate

Due

In cities or towns where

Gasoline

7764

50

91

1¢

gasoline tax is 1/4¢ or more

All other locations in Walker

Gasoline

7064

50

91

1 1/4¢

Co

Diesel Fuel #2

7064

2¢

All locations in Walker Co

50

93

Diesel Fuel #1 (Kerosene and

7064

50

93

2¢

All locations in Walker Co

other fuels)

Total Tax Due $________________________

* Sign Your Return - I declare under penalties of perjury that the above information (and any accompanying schedules) are to the best of my knowledge

and belief, a true and accurate statement for the period indicated.

Signed __________________________________________________Date_____________________ Telephone #______________________________

FORM DISCLAIMER:

Please note that the administration and rate changes on the RDS Advisory and RDS tax forms are updated once the required information has been received, verified, and validated in compliance with RDS policy. Any information received before or after the

publication of an RDS Advisory or tax form will not be guaranteed to appear on said forms until all such requirements have been met. RDS is not responsible for incorrect information and/or improper use of the information provided. All updates are completed on a timely basis once the

requirements have been met. For the most current RDS administration and/or rate information provided, please visit our website at RETURNED CHECK DISCLAIMER: When you make a payment by check, you authorize us to use information from your check to make a

one-time electronic fund transfer from your checking account according to the terms of your check or to process that transaction as a check. When we use your check to make an electronic fund transfer, funds may be withdrawn from your checking account as soon as the same day we

receive your payment, and you will not receive your check back from your financial institution. If there are insufficient funds in your checking account, you authorize us to charge a Returned Payment Fee in the amount set forth below and collect that amount through an electronic fund

transfer from your checking account, if permitted by applicable law. IF YOUR CHECK OR OTHER PAYMENT IS RETURNED UNPAID by your bank, we may, if permitted by applicable law, charge a Returned Payment Fee of $ 50 in KY and VA; $40 in DE and MS; $ 35 in MD; $30 in AL,

OH, SC, TN, and TX; $25 in AR, IL, MO, NC and WV; $20 in IN; the greater of 5% of the check or (i) $30 in GA or (ii) $25 in LA; the greater of 5% of the check or (i) $25 if the check is under $50, (ii) $30 if the check is between $50 and $300 or (iii) $40 if the check is over $300 in FL.

Effective July 1, 2010, each returned item received by RDS due to insufficient funds will be electronically represented to the presenters’ bank no more than two times in an effort to obtain payment. RDS is not responsible for any additional bank fees that will accrue due to the resubmission

of the returned item.

Remittance Address:

Tax Division PO Box 830725 Birmingham, AL 35283-0725 (800) 556-7274 Email: Website:

Walker County Gasoline/Motor Fuel Tax Form

June 2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1