Alatax Monthly Gasoline / Motor Fuels Tax Return Form

ADVERTISEMENT

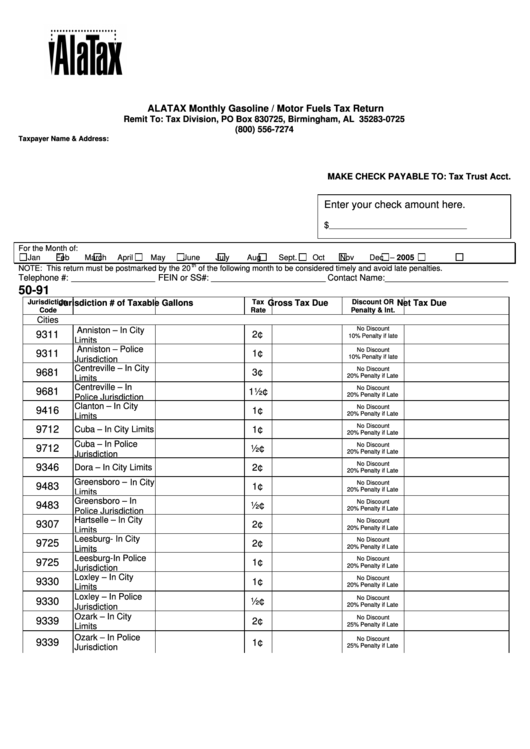

ALATAX Monthly Gasoline / Motor Fuels Tax Return

Remit To: Tax Division, PO Box 830725, Birmingham, AL 35283-0725

(800) 556-7274

Taxpayer Name & Address:

MAKE CHECK PAYABLE TO: Tax Trust Acct.

Enter your check amount here.

$

__________________________________________

For the Month of:

Jan

Feb

March

April

May

June

July

Aug

Sept.

Oct

Nov

Dec – 2005

th

NOTE: This return must be postmarked by the 20

of the following month to be considered timely and avoid late penalties.

Telephone #:

FEIN or SS#:

Contact Name:__________________________

___________________

__________________________

50-91

Jurisdiction

Jurisdiction

# of Taxable Gallons

Tax

Gross Tax Due

Discount OR

Net Tax Due

Code

Rate

Penalty & Int.

Cities

Anniston – In City

No Discount

9311

2¢

10% Penalty if late

Limits

Anniston – Police

No Discount

9311

1¢

10% Penalty if late

Jurisdiction

Centreville – In City

No Discount

9681

3¢

20% Penalty if Late

Limits

Centreville – In

No Discount

9681

1½¢

20% Penalty if Late

Police Jurisdiction

Clanton – In City

No Discount

9416

1¢

20% Penalty if Late

Limits

No Discount

9712

1¢

Cuba – In City Limits

20% Penalty if Late

Cuba – In Police

No Discount

9712

½¢

20% Penalty if Late

Jurisdiction

No Discount

9346

2¢

Dora – In City Limits

20% Penalty if Late

Greensboro – In City

No Discount

9483

1¢

20% Penalty if Late

Limits

Greensboro – In

No Discount

9483

½¢

20% Penalty if Late

Police Jurisdiction

Hartselle – In City

No Discount

9307

2¢

20% Penalty if Late

Limits

Leesburg- In City

No Discount

9725

2¢

20% Penalty if Late

Limits

Leesburg-In Police

No Discount

9725

1¢

20% Penalty if Late

Jurisdiction

Loxley – In City

No Discount

9330

1¢

Limits

20% Penalty if Late

Loxley – In Police

No Discount

9330

½¢

Jurisdiction

20% Penalty if Late

Ozark – In City

No Discount

9339

2¢

Limits

25% Penalty if Late

Ozark – In Police

No Discount

9339

1¢

Jurisdiction

25% Penalty if Late

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2