Reset Form

Michigan Department of Treasury

5013 (1-13)

Service Supplier’s State 9-1-1 Charge

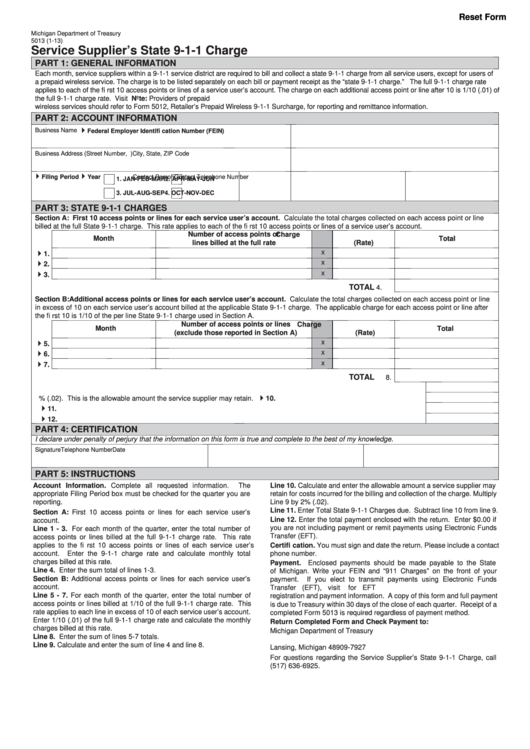

PART 1: GENERAL INFORMATION

Each month, service suppliers within a 9-1-1 service district are required to bill and collect a state 9-1-1 charge from all service users, except for users of

a prepaid wireless service. The charge is to be listed separately on each bill or payment receipt as the “state 9-1-1 charge.” The full 9-1-1 charge rate

applies to each of the fi rst 10 access points or lines of a service user’s account. The charge on each additional access point or line after 10 is 1/10 (.01) of

the full 9-1-1 charge rate. Visit for additional information and listing of current rate for 9-1-1 charges. Note: Providers of prepaid

wireless services should refer to Form 5012, Retailer’s Prepaid Wireless 9-1-1 Surcharge, for reporting and remittance information.

PART 2: ACCOUNT INFORMATION

Business Name

Federal Employer Identifi cation Number (FEIN)

Business Address (Street Number, P.O. Box)

City, State, ZIP Code

Filing Period

Year

Contact Person

Contact Telephone Number

1. JAN-FEB-MAR

2. APR-MAY-JUN

3. JUL-AUG-SEP

4. OCT-NOV-DEC

PART 3: STATE 9-1-1 CHARGES

Section A: First 10 access points or lines for each service user’s account. Calculate the total charges collected on each access point or line

billed at the full State 9-1-1 charge. This rate applies to each of the fi rst 10 access points or lines of a service user’s account.

Number of access points or

Charge

Month

Total

lines billed at the full rate

(Rate)

x

1.

x

2.

x

3.

TOTAL

4.

Section B: Additional access points or lines for each service user’s account. Calculate the total charges collected on each access point or line

in excess of 10 on each service user’s account billed at the applicable State 9-1-1 charge. The applicable charge for each access point or line after

the fi rst 10 is 1/10 of the per line State 9-1-1 charge used in Section A.

Number of access points or lines

Charge

Month

Total

(exclude those reported in Section A)

(Rate)

x

5.

x

6.

x

7.

TOTAL

8.

9. Total State 9-1-1 Charges collected. Add line 4 and line 8 ......................................................................................

9.

10. Multiply line 9 by 2% (.02). This is the allowable amount the service supplier may retain. ....................................

10.

11. Total State 9-1-1 Charges due. Subtract line 10 from line 9. ...................................................................................

11.

12. Total payment enclosed with this return.

12.

PART 4: CERTIFICATION

I declare under penalty of perjury that the information on this form is true and complete to the best of my knowledge.

Signature

Telephone Number

Date

PART 5: INSTRUCTIONS

Account Information. Complete all requested information.

The

Line 10. Calculate and enter the allowable amount a service supplier may

appropriate Filing Period box must be checked for the quarter you are

retain for costs incurred for the billing and collection of the charge. Multiply

reporting.

Line 9 by 2% (.02).

Line 11. Enter Total State 9-1-1 Charges due. Subtract line 10 from line 9.

Section A: First 10 access points or lines for each service user’s

Line 12. Enter the total payment enclosed with the return. Enter $0.00 if

account.

you are not including payment or remit payments using Electronic Funds

Line 1 - 3. For each month of the quarter, enter the total number of

Transfer (EFT).

access points or lines billed at the full 9-1-1 charge rate. This rate

applies to the fi rst 10 access points or lines of each service user’s

Certifi cation. You must sign and date the return. Please include a contact

account.

Enter the 9-1-1 charge rate and calculate monthly total

phone number.

charges billed at this rate.

Payment. Enclosed payments should be made payable to the State

Line 4. Enter the sum total of lines 1-3.

of Michigan. Write your FEIN and “911 Charges” on the front of your

Section B: Additional access points or lines for each service user’s

payment.

If you elect to transmit payments using Electronic Funds

account.

Transfer (EFT), visit for EFT

Line 5 - 7. For each month of the quarter, enter the total number of

registration and payment information. A copy of this form and full payment

access points or lines billed at 1/10 of the full 9-1-1 charge rate. This

is due to Treasury within 30 days of the close of each quarter. Receipt of a

rate applies to each line in excess of 10 of each service user’s account.

completed Form 5013 is required regardless of payment method.

Enter 1/10 (.01) of the full 9-1-1 charge rate and calculate the monthly

Return Completed Form and Check Payment to:

charges billed at this rate.

Michigan Department of Treasury

Line 8. Enter the sum of lines 5-7 totals.

P.O. Box 30427

Line 9. Calculate and enter the sum of line 4 and line 8.

Lansing, Michigan 48909-7927

For questions regarding the Service Supplier’s State 9-1-1 Charge, call

(517) 636-6925.

1

1