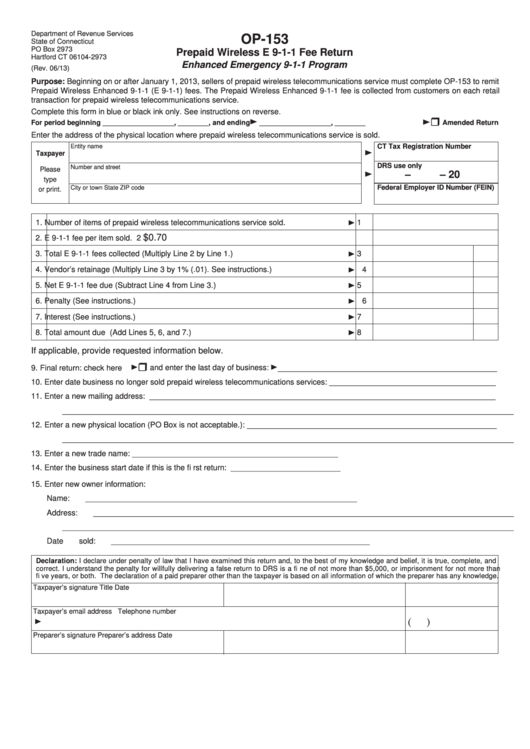

Department of Revenue Services

OP-153

State of Connecticut

PO Box 2973

Prepaid Wireless E 9-1-1 Fee Return

Hartford CT 06104-2973

Enhanced Emergency 9-1-1 Program

(Rev. 06/13)

Purpose: Beginning on or after January 1, 2013, sellers of prepaid wireless telecommunications service must complete OP-153 to remit

Prepaid Wireless Enhanced 9-1-1 (E 9-1-1) fees. The Prepaid Wireless Enhanced 9-1-1 fee is collected from customers on each retail

transaction for prepaid wireless telecommunications service.

Complete this form in blue or black ink only. See instructions on reverse.

_____________________

For period beginning

,

, and ending

,

Amended Return

_____________________

_________

_________

Enter the address of the physical location where prepaid wireless telecommunications service is sold.

CT Tax Registration Number

Entity name

Taxpayer

DRS use only

Number and street

Please

–

– 20

type

Federal Employer ID Number (FEIN)

City or town

State

ZIP code

or print.

1.

Number of items of prepaid wireless telecommunications service sold.

1

$0.70

2.

E 9-1-1 fee per item sold.

2

3.

Total E 9-1-1 fees collected (Multiply Line 2 by Line 1.)

3

4.

Vendor’s retainage (Multiply Line 3 by 1% (.01). See instructions.)

4

5.

Net E 9-1-1 fee due (Subtract Line 4 from Line 3.)

5

6.

Penalty (See instructions.)

6

7.

Interest (See instructions.)

7

8.

Total amount due (Add Lines 5, 6, and 7.)

8

If applicable, provide requested information below.

9.

Final return: check here

and enter the last day of business:

__________________________________________________

10. Enter date business no longer sold prepaid wireless telecommunications services: ______________________________________

11. Enter a new mailing address: _______________________________________________________________________________

_______________________________________________________________________________________________________

12. Enter a new physical location (PO Box is not acceptable.): _________________________________________________________

_______________________________________________________________________________________________________

13. Enter a new trade name: _______________________________________________

14. Enter the business start date if this is the fi rst return: _________________________

15. Enter new owner information:

Name: ______________________________________________________________

Address: ________________________________________________________________________________________________

_______________________________________________________________________________________________________

Date sold: ___________________________________________________________

Declaration: I declare under penalty of law that I have examined this return and, to the best of my knowledge and belief, it is true, complete, and

correct. I understand the penalty for willfully delivering a false return to DRS is a fi ne of not more than $5,000, or imprisonment for not more than

fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer’s signature

Title

Date

Taxpayer’s email address

Telephone number

(

)

Preparer’s signature

Preparer’s address

Date

1

1 2

2