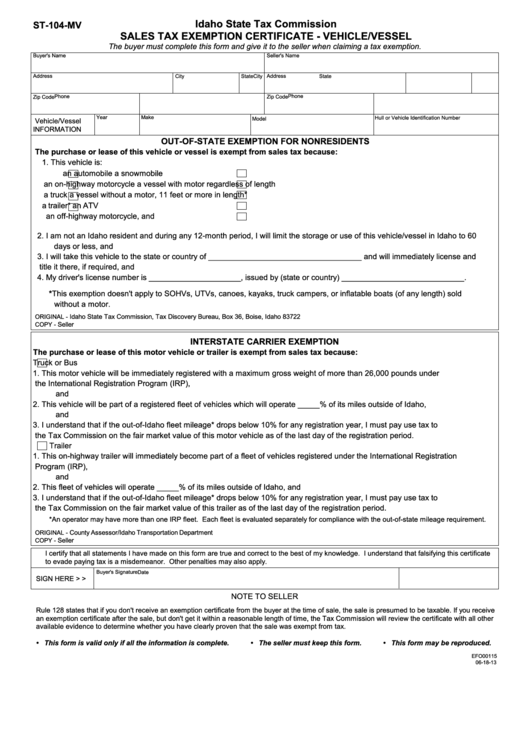

Idaho State Tax Commission

ST-104-MV

SALES TAX EXEMPTION CERTIFICATE - VEHICLE/VESSEL

The buyer must complete this form and give it to the seller when claiming a tax exemption.

Buyer's Name

Seller's Name

Address

Address

City

State

City

State

Phone

Phone

Zip Code

Zip Code

Year

Make

Hull or Vehicle Identification Number

Model

Vehicle/Vessel

INFORMATION

OUT-OF-STATE EXEMPTION FOR NONRESIDENTS

The purchase or lease of this vehicle or vessel is exempt from sales tax because:

1. This vehicle is:

an automobile

a snowmobile

an on-highway motorcycle

a vessel with motor regardless of length

a truck

a vessel without a motor, 11 feet or more in length*

a trailer*

an ATV

an off-highway motorcycle, and

2. I am not an Idaho resident and during any 12-month period, I will limit the storage or use of this vehicle/vessel in Idaho to 60

days or less, and

3. I will take this vehicle to the state or country of ___________________________________ and will immediately license and

title it there, if required, and

4. My driver's license number is _____________________, issued by (state or country) ____________________________.

*This exemption doesn't apply to SOHVs, UTVs, canoes, kayaks, truck campers, or inflatable boats (of any length) sold

without a motor.

Idaho State Tax Commission, Tax Discovery Bureau, Box 36, Boise, Idaho 83722

ORIGINAL -

Seller

COPY -

INTERSTATE CARRIER EXEMPTION

The purchase or lease of this motor vehicle or trailer is exempt from sales tax because:

Truck or Bus

1. This motor vehicle will be immediately registered with a maximum gross weight of more than 26,000 pounds under

the International Registration Program (IRP),

and

2. This vehicle will be part of a registered fleet of vehicles which will operate _____% of its miles outside of Idaho,

and

3. I understand that if the out-of-Idaho fleet mileage* drops below 10% for any registration year, I must pay use tax to

the Tax Commission on the fair market value of this motor vehicle as of the last day of the registration period.

Trailer

1. This on-highway trailer will immediately become part of a fleet of vehicles registered under the International Registration

Program (IRP),

and

2. This fleet of vehicles will operate _____% of its miles outside of Idaho, and

3. I understand that if the out-of-Idaho fleet mileage* drops below 10% for any registration year, I must pay use tax to

the Tax Commission on the fair market value of this trailer as of the last day of the registration period.

*An operator may have more than one IRP fleet. Each fleet is evaluated separately for compliance with the out-of-state mileage requirement.

County Assessor/Idaho Transportation Department

ORIGINAL -

Seller

COPY -

I certify that all statements I have made on this form are true and correct to the best of my knowledge. I understand that falsifying this certificate

to evade paying tax is a misdemeanor. Other penalties may also apply.

Buyer's Signature

Date

SIGN HERE > >

NOTE TO SELLER

Rule 128 states that if you don't receive an exemption certificate from the buyer at the time of sale, the sale is presumed to be taxable. If you receive

an exemption certificate after the sale, but don't get it within a reasonable length of time, the Tax Commission will review the certificate with all other

available evidence to determine whether you have clearly proven that the sale was exempt from tax.

• This form is valid only if all the information is complete.

• The seller must keep this form.

• This form may be reproduced.

EFO00115

06-18-13

1

1 2

2