Form Ucs-1s - Report To Determine Succession And Application For Transfer Of Experience Rating Records Page 2

ADVERTISEMENT

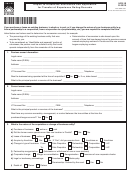

4. What is the nature of the acquisition or change of business entity?

a) ______ Purchase of business

b) _______ Lease of business

c) _______ Acquire by franchise

______ entire or _______ part

_______ entire or _______ part

_______ Yes _______ No

If “Yes”, did you acquire from:

_______ franchisee or _______ franchiser

d)

Change in type of business

From: ________ Sole Proprietor ________ Partnership ___________ Corporation

To:

________ Sole Proprietor ________ Partnership ___________ Corporation

e)

Partnership Reorganization (Admission or withdrawal of one or more partners) ____________________

f)

Corporate change ________________

g) Legal or insolvency proceedings __________________

______ Merger or Consolidation

______ Foreclosure

______ Bankruptcy

______ Reorganization

______ Receivership

______ Issuance of new Corporate Charter

Ordered by the Court

_____ Yes

_____ No

h)

Death of:

i) Did the former owner operate more than one location in Florida?

______ Owner ______ Partner

______ Yes

______ No

5. Succession

a)

Total Succession (You have acquired 100% of the business)

In consideration of the transfer, the successor will be responsible for any indebtedness that is past due with respect to wages paid by

the predecessor prior to the date of succession. Any unemployment benefits paid to former employees of the predecessor will be

charged to the successor employer and will be used in future tax rate calculations.

The successor employer does hereby request a transfer of the employment records from the account of the predecessor employer.

_____________________________________________________

________________________

_______________

Successor Signature

Title

Date

b)

Partial Succession (You have acquired less than 100% of a business that is an identifiable and segregable portion of the business)

The successor employer does hereby request a partial transfer of the employment records from the account of the predecessor

employer.

_____________________________________________________

________________________

_______________

Successor Signature

Title

Date

To be completed by the predecessor employer:

Total number of predecessor employees prior to transfer: __________________________________________________________

Number of employees in identifiable and segregable unit transferred: _________________________________________________

Beginning date of business activity for unit being transferred: _______________________________________________________

“Total number of predecessor employees” should include all employees employed by the predecessor prior to the unit being sold

(including those in sold unit).

By transferring a percentage of my business to another, and signing this form authorizing the transfer of the employment history of such

percentage to a successor employer, I understand that my future tax rate may be affected.

_____________________________________________________

________________________

_______________

Predecessor Signature

Title

Date

6.

The successor employer does hereby refuse a transfer of the employment records from the account of the

predecessor employer.

_____________________________________________________

________________________

_______________

Successor Signature

Title

Date

1-800-482-8293

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2