Form Rts-1s - Report To Determine Succession And Application For Transfer Of Experience Rating Records

ADVERTISEMENT

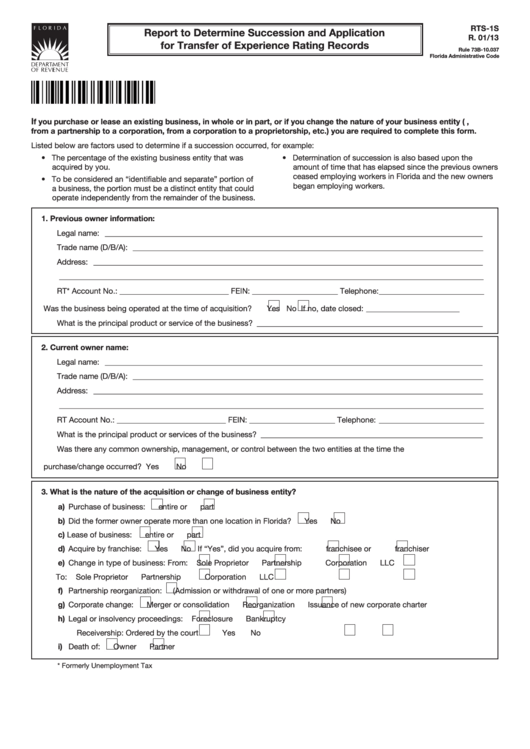

RTS-1S

Report to Determine Succession and Application

R. 01/13

for Transfer of Experience Rating Records

Rule 73B-10.037

Florida Administrative Code

I

f you purchase or lease an existing business, in whole or in part, or if you change the nature of your business entity (e.g.,

from a partnership to a corporation, from a corporation to a proprietorship, etc.) you are required to complete this form.

Listed below are factors used to determine if a succession occurred, for example:

• The percentage of the existing business entity that was

• Determination of succession is also based upon the

acquired by you.

amount of time that has elapsed since the previous owners

ceased employing workers in Florida and the new owners

• To be considered an “identifiable and separate” portion of

began employing workers.

a business, the portion must be a distinct entity that could

operate independently from the remainder of the business.

1.

Previous owner information:

Legal name: _________________________________________________________________________________________________

Trade name (D/B/A): __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

RT* Account No.: ____________________________ FEIN: ______________________ Telephone: ___________________________

Was the business being operated at the time of acquisition?

Yes

No If no, date closed: ________________________

What is the principal product or service of the business? __________________________________________________________

2.

Current owner name:

Legal name: _________________________________________________________________________________________________

Trade name (D/B/A): __________________________________________________________________________________________

Address: ____________________________________________________________________________________________________

_____________________________________________________________________________________________________________

RT Account No.: ____________________________ FEIN: ______________________ Telephone: ___________________________

What is the principal product or services of the business? _________________________________________________________

Was there any common ownership, management, or control between the two entities at the time the

purchase/change occurred? Yes

No

3.

What is the nature of the acquisition or change of business entity?

a) Purchase of business:

entire or

part

b) Did the former owner operate more than one location in Florida?

Yes

No

c) Lease of business:

entire or

part

d) Acquire by franchise:

Yes

No If “Yes”, did you acquire from:

franchisee or

franchiser

e) Change in type of business: From:

Sole Proprietor

Partnership

Corporation

LLC

To:

Sole Proprietor

Partnership

Corporation

LLC

f) Partnership reorganization:

(Admission or withdrawal of one or more partners)

g) Corporate change:

Merger or consolidation

Reorganization

Issuance of new corporate charter

h) Legal or insolvency proceedings:

Foreclosure

Bankruptcy

Receivership: Ordered by the court

Yes

No

i) Death of:

Owner

Partner

* Formerly Unemployment Tax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2