Instructions For Form It-210

ADVERTISEMENT

Form IT -210-

1

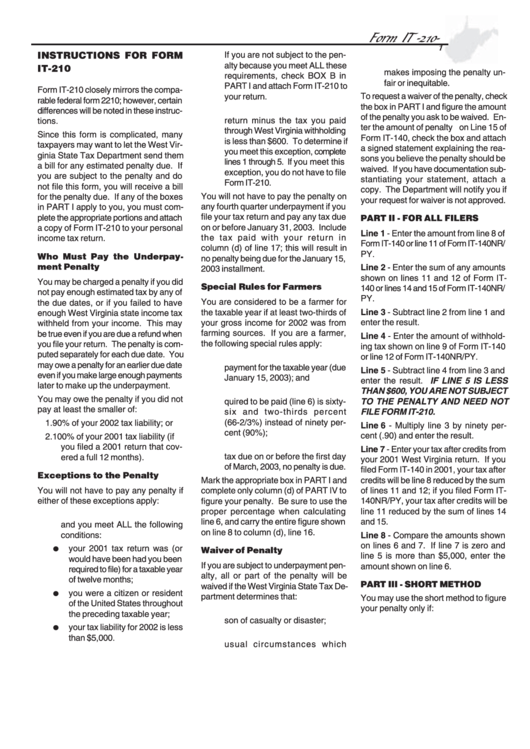

INSTRUCTIONS FOR FORM

If you are not subject to the pen-

alty because you meet ALL these

IT-210

makes imposing the penalty un-

requirements, check BOX B in

fair or inequitable.

PART I and attach Form IT-210 to

Form IT-210 closely mirrors the compa-

your return.

To request a waiver of the penalty, check

rable federal form 2210; however, certain

the box in PART I and figure the amount

2. The total tax shown on your 2002

differences will be noted in these instruc-

of the penalty you ask to be waived. En-

return minus the tax you paid

tions.

ter the amount of penalty on Line 15 of

through West Virginia withholding

Since this form is complicated, many

Form IT-140, check the box and attach

is less than $600. To determine if

taxpayers may want to let the West Vir-

a signed statement explaining the rea-

you meet this exception, complete

ginia State Tax Department send them

sons you believe the penalty should be

lines 1 through 5. If you meet this

a bill for any estimated penalty due. If

waived. If you have documentation sub-

exception, you do not have to file

you are subject to the penalty and do

stantiating your statement, attach a

Form IT-210.

not file this form, you will receive a bill

copy. The Department will notify you if

You will not have to pay the penalty on

for the penalty due. If any of the boxes

your request for waiver is not approved.

any fourth quarter underpayment if you

in PART I apply to you, you must com-

file your tax return and pay any tax due

plete the appropriate portions and attach

PART II - FOR ALL FILERS

on or before January 31, 2003. Include

a copy of Form IT-210 to your personal

Line 1 - Enter the amount from line 8 of

the tax paid with your return in

income tax return.

Form IT-140 or line 11 of Form IT-140NR/

column (d) of line 17; this will result in

PY.

Who Must Pay the Underpay-

no penalty being due for the January 15,

ment Penalty

Line 2 - Enter the sum of any amounts

2003 installment.

shown on lines 11 and 12 of Form IT-

You may be charged a penalty if you did

Special Rules for Farmers

140 or lines 14 and 15 of Form IT-140NR/

not pay enough estimated tax by any of

PY.

You are considered to be a farmer for

the due dates, or if you failed to have

Line 3 - Subtract line 2 from line 1 and

the taxable year if at least two-thirds of

enough West Virginia state income tax

your gross income for 2002 was from

enter the result.

withheld from your income. This may

farming sources. If you are a farmer,

be true even if you are due a refund when

Line 4 - Enter the amount of withhold-

the following special rules apply:

you file your return. The penalty is com-

ing tax shown on line 9 of Form IT-140

puted separately for each due date. You

1. You are only required to make one

or line 12 of Form IT-140NR/PY.

may owe a penalty for an earlier due date

payment for the taxable year (due

Line 5 - Subtract line 4 from line 3 and

even if you make large enough payments

January 15, 2003); and

enter the result. IF LINE 5 IS LESS

later to make up the underpayment.

2. The amount of estimated tax re-

THAN $600, YOU ARE NOT SUBJECT

You may owe the penalty if you did not

TO THE PENALTY AND NEED NOT

quired to be paid (line 6) is sixty-

pay at least the smaller of:

FILE FORM IT-210.

six and two-thirds percent

(66-2/3%) instead of ninety per-

1. 90% of your 2002 tax liability; or

Line 6 - Multiply line 3 by ninety per-

cent (90%);

cent (.90) and enter the result.

2. 100% of your 2001 tax liability (if

3. If you file your return and pay the

you filed a 2001 return that cov-

Line 7 - Enter your tax after credits from

tax due on or before the first day

ered a full 12 months).

your 2001 West Virginia return. If you

of March, 2003, no penalty is due.

filed Form IT-140 in 2001, your tax after

Exceptions to the Penalty

Mark the appropriate box in PART I and

credits will be line 8 reduced by the sum

You will not have to pay any penalty if

of lines 11 and 12; if you filed Form IT-

complete only column (d) of PART IV to

either of these exceptions apply:

figure your penalty. Be sure to use the

140NR/PY, your tax after credits will be

proper percentage when calculating

line 11 reduced by the sum of lines 14

1. You had no tax liability for 2001

and 15.

line 6, and carry the entire figure shown

and you meet ALL the following

on line 8 to column (d), line 16.

conditions:

Line 8 - Compare the amounts shown

on lines 6 and 7. If line 7 is zero and

●

your 2001 tax return was (or

Waiver of Penalty

line 5 is more than $5,000, enter the

would have been had you been

If you are subject to underpayment pen-

amount shown on line 6.

required to file) for a taxable year

alty, all or part of the penalty will be

of twelve months;

PART III - SHORT METHOD

waived if the West Virginia State Tax De-

●

you were a citizen or resident

partment determines that:

You may use the short method to figure

of the United States throughout

your penalty only if:

1. The penalty was caused by rea-

the preceding taxable year;

son of casualty or disaster;

●

your tax liability for 2002 is less

2. The penalty was caused by un-

than $5,000.

usual circumstances which

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4