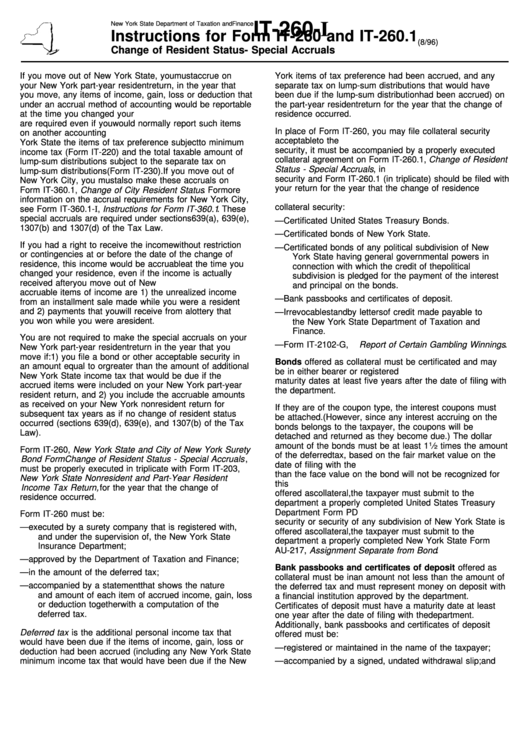

Instructions For Form It-260 And It-260.1 - Change Of Resident Status - Special Accruals

ADVERTISEMENT

IT-260-I

New York State Department of Taxation and Finance

Instructions for Form IT-260 and IT-260.1

(8/96)

Change of Resident Status - Special Accruals

If you move out of New York State, you must accrue on

York items of tax preference had been accrued, and any

your New York part-year resident return, in the year that

separate tax on lump-sum distributions that would have

you move, any items of income, gain, loss or deduction that

been due if the lump-sum distribution had been accrued) on

under an accrual method of accounting would be reportable

the part-year resident return for the year that the change of

at the time you changed your residence. These accruals

residence occurred.

are required even if you would normally report such items

In place of Form IT-260, you may file collateral security

on another accounting basis. You must also accrue to New

acceptable to the department. If you decide to file collateral

York State the items of tax preference subject to minimum

security, it must be accompanied by a properly executed

income tax (Form IT-220) and the total taxable amount of

collateral agreement on Form IT-260.1, Change of Resident

lump-sum distributions subject to the separate tax on

Status - Special Accruals , in triplicate. Both the collateral

lump-sum distributions (Form IT-230). If you move out of

security and Form IT-260.1 (in triplicate) should be filed with

New York City, you must also make these accruals on

your return for the year that the change of residence

Form IT-360.1, Change of City Resident Status . For more

occurred. The following kinds of security will be accepted as

information on the accrual requirements for New York City,

collateral security:

see Form IT-360.1-I, Instructions for Form IT-360.1 . These

special accruals are required under sections 639(a), 639(e),

— Certificated United States Treasury Bonds.

1307(b) and 1307(d) of the Tax Law.

— Certificated bonds of New York State.

If you had a right to receive the income without restriction

— Certificated bonds of any political subdivision of New

or contingencies at or before the date of the change of

York State having general governmental powers in

residence, this income would be accruable at the time you

connection with which the credit of the political

changed your residence, even if the income is actually

subdivision is pledged for the payment of the interest

received after you move out of New York. Examples of

and principal on the bonds.

accruable items of income are 1) the unrealized income

— Bank passbooks and certificates of deposit.

from an installment sale made while you were a resident

and 2) payments that you will receive from a lottery that

— Irrevocable standby letters of credit made payable to

you won while you were a resident.

the New York State Department of Taxation and

Finance.

You are not required to make the special accruals on your

— Form IT-2102-G, Report of Certain Gambling Winnings .

New York part-year resident return in the year that you

move if: 1) you file a bond or other acceptable security in

Bonds offered as collateral must be certificated and may

an amount equal to or greater than the amount of additional

be in either bearer or registered form. They must have

New York State income tax that would be due if the

maturity dates at least five years after the date of filing with

accrued items were included on your New York part-year

the department.

resident return, and 2) you include the accruable amounts

as received on your New York nonresident return for

If they are of the coupon type, the interest coupons must

subsequent tax years as if no change of resident status

be attached. (However, since any interest accruing on the

occurred (sections 639(d), 639(e), and 1307(b) of the Tax

bonds belongs to the taxpayer, the coupons will be

Law).

detached and returned as they become due.) The dollar

1

amount of the bonds must be at least 1

⁄

times the amount

2

Form IT-260, New York State and City of New York Surety

of the deferred tax, based on the fair market value on the

Bond Form Change of Resident Status - Special Accruals ,

date of filing with the department. Fair market value greater

must be properly executed in triplicate with Form IT-203,

than the face value on the bond will not be recognized for

New York State Nonresident and Part-Year Resident

this purpose. If registered United States Treasury Bonds are

Income Tax Return, for the year that the change of

offered as collateral, the taxpayer must submit to the

residence occurred.

department a properly completed United States Treasury

Department Form PD 1832. If a registered New York State

Form IT-260 must be:

security or security of any subdivision of New York State is

— executed by a surety company that is registered with,

offered as collateral, the taxpayer must submit to the

and under the supervision of, the New York State

department a properly completed New York State Form

Insurance Department;

AU-217, Assignment Separate from Bond .

— approved by the Department of Taxation and Finance;

Bank passbooks and certificates of deposit offered as

— in the amount of the deferred tax;

collateral must be in an amount not less than the amount of

— accompanied by a statement that shows the nature

the deferred tax and must represent money on deposit with

and amount of each item of accrued income, gain, loss

a financial institution approved by the department.

or deduction together with a computation of the

Certificates of deposit must have a maturity date at least

deferred tax.

one year after the date of filing with the department.

Additionally, bank passbooks and certificates of deposit

Deferred tax is the additional personal income tax that

offered must be:

would have been due if the items of income, gain, loss or

— registered or maintained in the name of the taxpayer;

deduction had been accrued (including any New York State

minimum income tax that would have been due if the New

— accompanied by a signed, undated withdrawal slip; and

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2