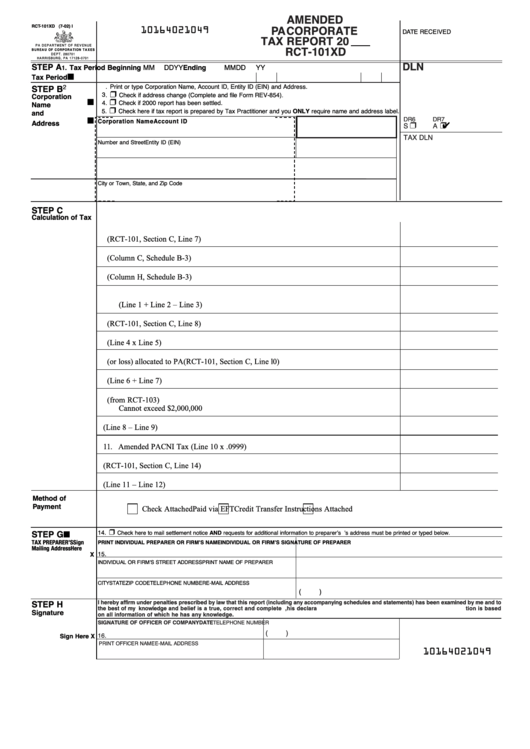

Form Rct-101xd - Amended Pa Corporate Tax Report

ADVERTISEMENT

AMENDED

DEPARTMENT USE ONLY

RCT-101XD (7-02) I

10164021049

PA CORPORATE

DATE RECEIVED

TAX REPORT 20

P A D E P A R T M E N T O F R E V E N U E

RCT-101XD

B U R E A U O F C O R P O R A T I O N T A X E S

D E P T . 2 8 0 7 0 1

H A R R I S B U R G , P A 1 7 1 2 8 - 0 7 0 1

DLN

STEP A

Tax Period Beginning

MM

DD

YY

Ending

MM

DD

YY

1.

■

Tax Period

2. Print or type Corporation Name, Account ID, Entity ID (EIN) and Address.

STEP B

❒

3.

Check if address change (Complete and file Form REV-854).

Corporation

■

❒

4.

Check if 2000 report has been settled.

Name

❒

5.

Check here if tax report is prepared by Tax Practitioner and you ONLY require name and address label.

and

■

DR6

DR7

Corporation Name

Account ID

❒

❒

✔

Address

S

A

TAX DLN

Number and Street

Entity ID (EIN)

City or Town, State, and Zip Code

STEP C

Calculation of Tax

1. Income to be Apportioned-as filed (RCT-101, Section C, Line 7)

2. Increase for Bonus Depreciation (Column C, Schedule B-3)

3. Decrease for Additional PA Depreciation (Column H, Schedule B-3)

4. Income to be Apportioned without Depreciation Adjustments

(Line 1 + Line 2 – Line 3)

5. Apportionment as filed (RCT-101, Section C, Line 8)

6. Amended Income Apportioned to PA (Line 4 x Line 5)

7. Non-business income (or loss) allocated to PA (RCT-101, Section C, Line l0)

8. Amended Taxable income or loss (Line 6 + Line 7)

9. Less Net Operating Deductions (from RCT-103)

Cannot exceed $2,000,000

10. Amended PA Taxable Income (Line 8 – Line 9)

11. Amended PA CNI Tax (Line 10 x .0999)

12. PA CNI Tax as filed (RCT-101, Section C, Line 14)

13. Additional PA CNI Tax Due to Depreciation Adjustments (Line 11 – Line 12)

Method of

Payment

Check Attached

Paid via EFT

Credit Transfer Instructions Attached

❒

■

14.

Check here to mail settlement notice AND requests for additional information to preparer’s address. Preparer’s address must be printed or typed below.

STEP G

TAX PREPARER’S

Sign

PRINT INDIVIDUAL PREPARER OR FIRM’S NAME

INDIVIDUAL OR FIRM’S SIGNATURE OF PREPARER

Mailing Address

Here

15.

X

INDIVIDUAL OR FIRM’S STREET ADDRESS

PRINT NAME OF PREPARER

CITY

STATE

ZIP CODE

TELEPHONE NUMBER

E-MAIL ADDRESS

(

)

I hereby affirm under penalties prescribed by law that this report (including any accompanying schedules and statements) has been examined by me and to

STEP H

the best of my knowledge and belief is a true, correct and complete report. If prepared by a person other than the taxpayer, his declaration is based

Signature

on all information of which he has any knowledge.

SIGNATURE OF OFFICER OF COMPANY

DATE

TELEPHONE NUMBER

(

)

16.

Sign Here X

PRINT OFFICER NAME

E-MAIL ADDRESS

10164021049

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1