Home Ownership Expression Of Interest - Indigenous Business Australia (Iba) Page 4

ADVERTISEMENT

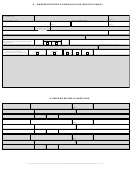

F. FINANCIAL DETAILS

Please give details of your combined savings (that is Applicant 1 and Applicant 2).

Name of financial institution

Branch

Current balance

$

$

$

Total savings

$

Please give details of your other commitments (for example, car loans, personal loans, credit cards, store accounts,

or debtor arrangements).

Lender

Commitment type

Monthly

Balance

Card

Payments are

payment

of loan

limit

(eg: car loan)

Up to date In arrears

$

$

$

$

$

$

$

$

$

$

$

$

Please give details of other commitments you have paid off in the past two years (for example, car loans, personal

loans, credit cards, store accounts, or debtor arrangements).

Lender

Commitment type

Loan

Repaid in

Length of loan

amount

(year)

(no. of years)

(eg: car loan)

$

$

$

$

Have you ever received a loan from IBA, ATSIC, ADC or ALC?

Yes / No

If yes, please specify the borrower’s name/s

Property (address) or business

(business name) that loan is / was for

Loan number if known

G. PURPOSE FOR IBA HOUSING LOAN

If eligible to apply for an IBA housing loan, I / we wish to:

Buy an established home

Build a home on land I own or am paying off

Buy a house and land package

Do home improvements, repairs or maintenance

Buy a flat, townhouse or unit

Refinance an existing housing loan

Buy land and build a home

Buy out my partner’s share of property (property settlement)

Not sure yet

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8