Instructions For Form 1128 - Application To Adopt, Change, Or Retain A Tax Year - 1996

ADVERTISEMENT

1992-1 C.B. 665, as modified by Rev.

Department of the Treasury

Proc. 94-12, 1994-1 C.B. 565, and as

modified and amplified by Rev. Proc.

Internal Revenue Service

92-13A, 1992-1 C.B. 668, every member

of the group must meet the revenue

Instructions for Form 1128

procedure requirements and comply with

its conditions.

If an applicant requests a change to a

(Rev. April 1996)

52–53 week tax year and, in addition,

requests to change the month with

Application To Adopt, Change, or Retain a Tax Year

reference to which the tax year ends,

the applicant must first get approval by

Section references are to the Internal Revenue Code unless otherwise noted.

filing Form 1128. Prior approval is also

necessary for a change from a 52–53

Paperwork Reduction Act Notice and Privacy Act Notice

week year to any other tax year,

We ask for the information on this form to carry out the Internal Revenue laws of the

including another 52–53 week year.

United States. Code section 442 says that you must obtain IRS approval if you want

For more information, see Temporary

to adopt, change, or retain a tax year. To obtain approval, you are required to file an

Regulations sections 1.441-2T(c)(4),

application to adopt, change, or retain a tax year. Section 6109 requires that you

1.1502-76(a)(1), and Pub. 538.

disclose your taxpayer identification number (SSN or EIN). Routine uses of this

information include giving it to the Department of Justice for civil and criminal

Who Does Not File

litigation and to cities, states, and the District of Columbia for use in administering

Do not file Form 1128 in the following

their tax laws. Failure to provide this information in a timely manner could result in

circumstances.

approval of your application being delayed or withheld.

1. A corporation that meets the terms

You are not required to provide the information requested on a form that is subject

of Regulations section 1.442-1(c) and

to the Paperwork Reduction Act unless the form displays a valid OMB control

files the required statement with its tax

number. Books or records relating to a form or its instructions must be retained as

return to change its tax year.

long as their contents may become material in the administration of any Internal

2. A subsidiary corporation required to

Revenue law. Generally, tax returns and return information are confidential, as

change its tax year to file a consolidated

required by Code section 6103.

return with its parent (see Regulations

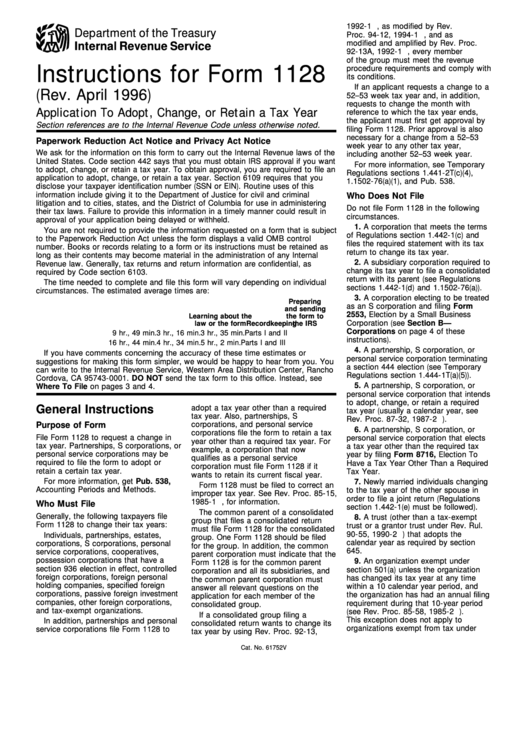

The time needed to complete and file this form will vary depending on individual

sections 1.442-1(d) and 1.1502-76(a)).

circumstances. The estimated average times are:

3. A corporation electing to be treated

Preparing

as an S corporation and filing Form

and sending

2553, Election by a Small Business

Learning about the

the form to

Corporation (see Section B—

Recordkeeping

law or the form

the IRS

Corporations on page 4 of these

Parts I and II

9 hr., 49 min.

3 hr., 16 min.

3 hr., 35 min.

instructions).

Parts I and III

16 hr., 44 min.

4 hr., 34 min.

5 hr., 2 min.

4. A partnership, S corporation, or

If you have comments concerning the accuracy of these time estimates or

personal service corporation terminating

suggestions for making this form simpler, we would be happy to hear from you. You

a section 444 election (see Temporary

can write to the Internal Revenue Service, Western Area Distribution Center, Rancho

Regulations section 1.444-1T(a)(5)).

Cordova, CA 95743-0001. DO NOT send the tax form to this office. Instead, see

5. A partnership, S corporation, or

Where To File on pages 3 and 4.

personal service corporation that intends

to adopt, change, or retain a required

General Instructions

adopt a tax year other than a required

tax year (usually a calendar year, see

tax year. Also, partnerships, S

Rev. Proc. 87-32, 1987-2 C.B. 396).

corporations, and personal service

Purpose of Form

6. A partnership, S corporation, or

corporations file the form to retain a tax

File Form 1128 to request a change in

personal service corporation that elects

year other than a required tax year. For

tax year. Partnerships, S corporations, or

a tax year other than the required tax

example, a corporation that now

personal service corporations may be

year by filing Form 8716, Election To

qualifies as a personal service

required to file the form to adopt or

Have a Tax Year Other Than a Required

corporation must file Form 1128 if it

retain a certain tax year.

Tax Year.

wants to retain its current fiscal year.

For more information, get Pub. 538,

7. Newly married individuals changing

Form 1128 must be filed to correct an

Accounting Periods and Methods.

to the tax year of the other spouse in

improper tax year. See Rev. Proc. 85-15,

order to file a joint return (Regulations

1985-1 C.B. 516, for information.

Who Must File

section 1.442-1(e) must be followed).

The common parent of a consolidated

Generally, the following taxpayers file

8. A trust (other than a tax-exempt

group that files a consolidated return

Form 1128 to change their tax years:

trust or a grantor trust under Rev. Rul.

must file Form 1128 for the consolidated

90-55, 1990-2 C.B. 161) that adopts the

Individuals, partnerships, estates,

group. One Form 1128 should be filed

calendar year as required by section

corporations, S corporations, personal

for the group. In addition, the common

645.

service corporations, cooperatives,

parent corporation must indicate that the

possession corporations that have a

9. An organization exempt under

Form 1128 is for the common parent

section 936 election in effect, controlled

section 501(a) unless the organization

corporation and all its subsidiaries, and

foreign corporations, foreign personal

has changed its tax year at any time

the common parent corporation must

holding companies, specified foreign

within a 10 calendar year period, and

answer all relevant questions on the

corporations, passive foreign investment

the organization has had an annual filing

application for each member of the

companies, other foreign corporations,

requirement during that 10-year period

consolidated group.

and tax-exempt organizations.

(see Rev. Proc. 85-58, 1985-2 C.B. 740).

If a consolidated group filing a

This exception does not apply to

In addition, partnerships and personal

consolidated return wants to change its

organizations exempt from tax under

service corporations file Form 1128 to

tax year by using Rev. Proc. 92-13,

Cat. No. 61752V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4