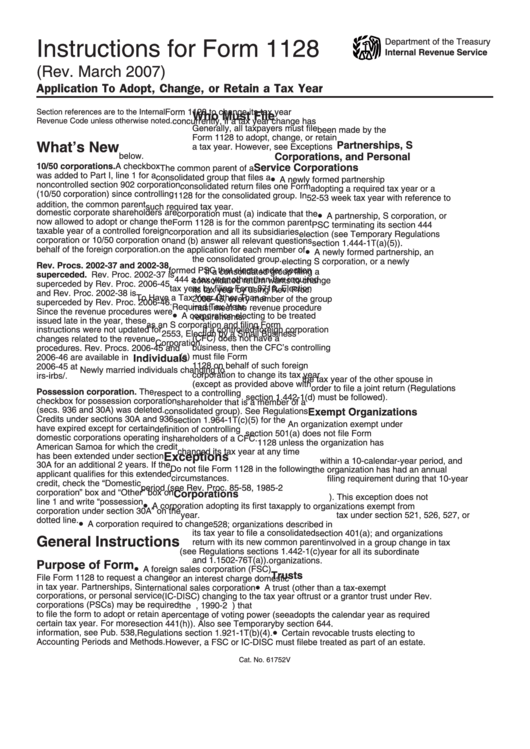

Instructions For Form 1128 - Application To Adopt, Change, Or Retain A Tax Year - 2007

ADVERTISEMENT

Department of the Treasury

Instructions for Form 1128

Internal Revenue Service

(Rev. March 2007)

Application To Adopt, Change, or Retain a Tax Year

Form 1128 to change its tax year

Section references are to the Internal

Who Must File

Revenue Code unless otherwise noted.

concurrently, if a tax year change has

Generally, all taxpayers must file

been made by the U.S. shareholder.

Form 1128 to adopt, change, or retain

What’s New

Partnerships, S

a tax year. However, see Exceptions

below.

Corporations, and Personal

10/50 corporations. A checkbox

Service Corporations

The common parent of a

was added to Part I, line 1 for a

•

consolidated group that files a

A newly formed partnership

noncontrolled section 902 corporation

consolidated return files one Form

adopting a required tax year or a

(10/50 corporation) since controlling

1128 for the consolidated group. In

52-53 week tax year with reference to

U.S. shareholders and majority

addition, the common parent

such required tax year.

domestic corporate shareholders are

•

corporation must (a) indicate that the

A partnership, S corporation, or

now allowed to adopt or change the

Form 1128 is for the common parent

PSC terminating its section 444

taxable year of a controlled foreign

corporation and all its subsidiaries

election (see Temporary Regulations

corporation or 10/50 corporation on

and (b) answer all relevant questions

section 1.444-1T(a)(5)).

•

behalf of the foreign corporation.

on the application for each member of

A newly formed partnership, an

the consolidated group.

electing S corporation, or a newly

Rev. Procs. 2002-37 and 2002-38

formed PSC that elects under section

If a consolidated group filing a

superceded. Rev. Proc. 2002-37 is

444 a tax year other than the required

consolidated return wants to change

superceded by Rev. Proc. 2006-45

tax year by filing Form 8716, Election

its tax year by using Rev. Proc.

and Rev. Proc. 2002-38 is

To Have a Tax Year Other Than a

2006-45, every member of the group

superceded by Rev. Proc. 2006-46.

Required Tax Year.

must meet the revenue procedure

Since the revenue procedures were

•

A corporation electing to be treated

requirements.

issued late in the year, these

as an S corporation and filing Form

instructions were not updated for

If a controlled foreign corporation

2553, Election by a Small Business

(CFC) does not have a U.S. trade or

changes related to the revenue

Corporation.

business, then the CFC’s controlling

procedures. Rev. Procs. 2006-45 and

U.S. shareholder(s) must file Form

2006-46 are available in I.R.B.

Individuals

1128 on behalf of such foreign

2006-45 at

Newly married individuals changing to

corporation to change its tax year

irs-irbs/irb06-45.pdf.

the tax year of the other spouse in

(except as provided above with

order to file a joint return (Regulations

Possession corporation. The

respect to a controlling U.S.

section 1.442-1(d) must be followed).

checkbox for possession corporation

shareholder that is a member of a

(secs. 936 and 30A) was deleted.

consolidated group). See Regulations

Exempt Organizations

Credits under sections 30A and 936

section 1.964-1T(c)(5) for the

An organization exempt under

have expired except for certain

definition of controlling U.S.

section 501(a) does not file Form

domestic corporations operating in

shareholders of a CFC.

1128 unless the organization has

American Samoa for which the credit

changed its tax year at any time

Exceptions

has been extended under section

within a 10-calendar-year period, and

30A for an additional 2 years. If the

Do not file Form 1128 in the following

the organization has had an annual

applicant qualifies for this extended

circumstances.

filing requirement during that 10-year

credit, check the “Domestic

period (see Rev. Proc. 85-58, 1985-2

corporation” box and “Other” box on

Corporations

C.B. 740). This exception does not

line 1 and write “possession

•

A corporation adopting its first tax

apply to organizations exempt from

corporation under section 30A” on the

year.

tax under section 521, 526, 527, or

dotted line.

•

A corporation required to change

528; organizations described in

its tax year to file a consolidated

section 401(a); and organizations

General Instructions

return with its new common parent

involved in a group change in tax

(see Regulations sections 1.442-1(c)

year for all its subordinate

and 1.1502-76T(a)).

organizations.

Purpose of Form

•

A foreign sales corporation (FSC)

Trusts

File Form 1128 to request a change

or an interest charge domestic

•

in tax year. Partnerships, S

international sales corporation

A trust (other than a tax-exempt

corporations, or personal service

(IC-DISC) changing to the tax year of

trust or a grantor trust under Rev.

corporations (PSCs) may be required

the U.S. shareholder with the highest

Rul. 90-55, 1990-2 C.B. 161) that

to file the form to adopt or retain a

percentage of voting power (see

adopts the calendar year as required

certain tax year. For more

section 441(h)). Also see Temporary

by section 644.

•

information, see Pub. 538,

Regulations section 1.921-1T(b)(4).

Certain revocable trusts electing to

Accounting Periods and Methods.

However, a FSC or IC-DISC must file

be treated as part of an estate.

Cat. No. 61752V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8