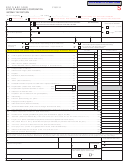

Instructions For Form 20s - Preparation Of Alabama Department Of Revenue S Corporation Information/tax Return - 2006 Page 3

ADVERTISEMENT

a. LIFO Recapture Tax. If the corporation became an Alabama S corpora-

tax payments made with Form CD (attach schedule).

tion after December 31, 1989 and inventoried goods under the LIFO method during

b. Enter the amount of tax paid on your extension Form 20-E.

its last year as an Alabama C corporation, it may be liable for LIFO recapture and

c. This line is only to be used if a taxpayer is filing an AMENDED RE-

resultant tax thereon. The LIFO recapture tax is figured for the last tax year the cor-

TURN. The amount shown should be any payments made with the original return

poration was an Alabama C corporation. The LIFO tax is paid in four equal install-

and/or any payments made because of adjustments to the return by the Alabama

ments. The first installment must be paid no later than the due date (without

Department of Revenue.

extension) for filing the corporate return for the last taxable year as a C corpora-

d. Tax Credits. Enter the amount from Schedule G, Line 3.

tion. The three succeeding installments must be paid not later than the due date

e. Enter total payment and credits (add lines 22a, 22b, 22c, and 22d).

(without extension) for the succeeding three years. See §40-18-161, Code of Ala-

Line 23. Enter the amount of total tax due.

bama 1975, as amended. Attach computation schedule. For tax years beginning

Line 24. Enter the amount of tax overpayment.

prior to January 1, 2001, a C corporation, which converts to an Alabama S corpora-

a. Enter the amount of the overpayment you wish to apply to next year’s

tion, shall pay tax equal to 5% of its LIFO recapture amount. For tax years begin-

estimated tax.

ning after December 31, 2000, a C corporation, which converts to an Alabama S

b. Enter the amount to be refunded. Refunds should be entered as a neg-

corporation, shall pay tax equal to 6-1/2% of its LIFO recapture amount.

ative, or in parenthesis.

Line 25. If this return is not filed on or before the due date (with extensions),

b. Built-in Gains Tax. Corporations which became S corporations after De-

cember 31, 1989 may be liable for this tax. The tax is computed by multiplying the

enter a failure to timely file penalty of 10% of the tax due on line 10 or $50,

whichever is greater. Amounts not paid by the due date will be subject to a failure

net recognized built-in gain of the Alabama S corporation for the taxable year by

to timely pay tax penalty of 1% per month up to a maximum of 25%.

5%. Section 40-18-174 defines “net recognized built-in gain,” with respect to any

Estimated taxes not paid by each due date will be subject to an underpayment

taxable year in the 10-year recognition period as the lesser of (i) the amount tax-

of estimated tax penalty in an amount determined by applying the underpayment

able if only recognized built-in gains/losses were taken into account, or (ii) the cor-

poration’s taxable income as determined under §40-18-161 and without regard to

rate established under 26 U.S.C. §6621, as provided in §40-2A-11.

the deduction provided by §§40-18-35(14), 35(15) and 35.1. A net operating loss

Line 26. Enter the amount of interest due on the balance of tax due, computed

from the due date (without extensions) of this return to the date paid. The Alabama

carryforward that arose in a taxable year for which the corporation was not an Ala-

interest rate is the same as provided in 26 U.S.C. §6621.

bama S corporation is allowed as a deduction against the net recognized built-in

Line 27. Enter the amount of total tax due.

gain of the Alabama S corporation for the taxable year. The amount of net recog-

nized built-in gain for a taxable year cannot exceed the excess (if any) of the net

Line 28. Enter the check amount of remitted with this return.

unrealized built-in gain over the net recognized built-in gain for prior taxable years

a. If the amount due is $750 or greater, it must be remitted by electronic

beginning in the recognition period. “Net unrealized built-in gain” means the

funds transfer. Section 41-1-20, Code of Alabama 1975 requires the use of Elec-

tronic Funds Transfer (EFT) for all single tax payments of $750 or more. Taxpayers

amount (if any) by which the fair market value of the assets of the corporation ex-

must register to use EFT and substantial penalties can be assessed for noncompli-

ceeds the aggregate basis of such assets as of the beginning of the first taxable

ance. Call the Alabama Department of Revenue EFT Hotline at (334) 242-0192 or

year for which the corporation is treated as an Alabama S corporation. This tax

does not apply if a corporation has had an S corporation status under Internal Rev-

1-800-322-4106, option 7 for further information.

enue Code for each of its taxable years.

COMPLETE ALL SCHEDULES ON THE FORM 20S.

The tax can apply to a corporation that has always been an Alabama S corpo-

SCHEDULE B – Allocation of Nonbusiness Income, Loss, and Expense

ration in any case where the S corporation acquires an asset and the basis of the

asset in the hands of the Alabama S corporation is determined in whole or in part

The purpose of Schedule B is to report nonbusiness income, nonbusiness

by reference to the basis of the asset in the hands of the Alabama C corporation.

losses, and nonbusiness expenses, as defined by Section 40-27-1, Code of Ala-

See §40-18-174. Attach computation schedule.

bama 1975, and as required by Section 40-18-22, Code of Alabama 1975. Non-

c. Excess Net Passive Income Tax. If an S corporation has subchapter C

business items can be both nonseparately stated items and separately stated

earnings and subchapter C earnings and profits, has passive investment income in

items. Nonbusiness items are not subject to the multistate apportionment require-

excess of 25% of gross receipts, and has taxable income at year end, it must pay a

ments of Chapter 27, Title 40, Code of Alabama 1975, but are allocated directly to

tax on the excess net passive income. The tax is computed by multiplying the ex-

Alabama or another state, in accordance with the Multistate Tax Compact (Chapter

cess net passive income by 5% percent. “Excess net passive income” means an

27, Title 40, Code of Alabama 1975). See the Alabama Department of Revenue’s

amount which bears the same ratio to the net passive income for the taxable year

Web site ( ) for additional information concerning Ala-

as (i) the amount by which the passive investment income for the taxable year ex-

bama’s mulitstate allocation and apportionment requirements.

ceeds 25% of the gross receipts for the taxable year, bears to (ii) the passive in-

Enter under the Nonseparately Stated Items heading on line 1a, line 1b,

vestment income for the taxable year. The amount of excess net passive income

and line 1c a description of the nonseparately stated item.

shall not exceed the S corporation’s income for the year as determined under §40-

For each nonseparately stated item entered on line 1a, line 1b and line 1c:

18-161. The term “net passive income” means passive investment income reduced

1. Enter on Column A the total gross income (from all states – everywhere)

by deductions allowed under Chapter 18, Title 40, Code of Alabama 1975. The

from the item.

terms “passive investment income” and “gross receipts” have the same meanings

2. Enter on Column B only the Alabama gross income from the item.

as when used in 26 U.S.C. §1362(d)(3). However, the amount of passive invest-

3. Enter on Column C the expenses related to the gross income (everywhere)

ment income shall be determined without using any recognized built-in gain or loss

entered in Column A.

of the Alabama S corporation for any taxable year in the 10 year recognition period.

4. Enter on Column D only the expenses related to the Alabama gross income

See §40-18-175. Attach computation schedule.

entered in Column B.

5. Enter on Column E the amount resulting from subtracting the expense

NOTE: You are required to submit a computation schedule. Failure to sub-

amount in Column C from the gross income (everywhere) amount in Column A.

mit the schedule may result in the assessment of penalties and additional fil-

6. Enter on Column F the amount resulting from subtracting the Alabama ex-

ing requirements.

pense amount in Column D from the Alabama gross income amount in Column B.

Line 22. Tax Payments, Credits, and Deferrals

Enter on Column E, line 1d, the sum of the amounts entered in Column E on

a. Enter the amount of tax carried over from last year plus any estimated

line 1a, line 1b, and line 1c. The amount entered in Column E, line 1d is the net

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6