TR-685 (6/02) (back)

Instructions

The selection of vendors for mandatory participation in the EFT

Line e

Enter the total of line a and line c.

program is based on historical tax liability. The hardship exemption

Example:

was established to account for a significant decrease in tax liability

The figure for this line is $150,000. Line a is $62,500 for

from the historical selection period to a more current period.

the quarter ended 5/95, and line c is $87,500 for the

You may qualify for hardship exemption if:

quarter ended 2/95.

1. The tax liability for the two most recent quarters is less than 50%

Line f

Enter the total of line b plus line d.

of the tax liability for the same two quarters of the prior year; and

Example:

2. The tax liability for the two most recent quarters plus the tax

The figure for this line is $325,000. Line b is $150,000 for

liability for the two quarters preceding the two most recent

the quarter ended 5/94, and line d is $175,000 for the

quarters multiplied by the percentage calculated in 1. above is

quarter ended 2/94.

less than $250,000.

Line g

Enter the amount derived by dividing line e by line f. This

If you believe you qualify for exemption based on criteria described

amount must be less than .50 in order to satisfy the first of

in section 10(b)(4) of the Tax Law, you may submit Form TR-685 to

two statutory hardship exemption criteria. The percentage

the Tax Department. To be considered for exemption, you must meet

must be calculated to three decimal places.

the stated criteria.

Example:

To determine the sales tax amount for each quarter, include both the

The line e figure of $150,000 is divided by the line f figure

tax liability shown on the applicable Form ST-810, (line 1) filed and

of $325,000, which equals .462.

any subsequent audit adjustments.

Line h

Enter the total sales and compensating use tax for the two

quarters that immediately preceded the two most current

The following is a step-by-step instruction for completing this form

quarters (lines a and c) and the month/year when each

using fictitious figures from the XYZ Corporation.

quarter ended.

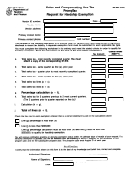

Quarter ended (MM/YY)

Sales tax amount

Example:

5/95

$

62,500

The two most recent quarters (ending 5/95 and 2/95) were

2/95

87,500

preceded by the quarters ending 11/94 and 8/94. The total

11/94

75,000

sales tax for these quarters was $175,000.

8/94

100,000

5/94

150,000

Line i

Multiply line g by line h and enter the result.

2/94

175,000

Example:

Vendor information — Enter your tax identification number as

.462 × $175,000 equals $80,850.

shown on your Official Letter of Notification, along with the company

name and address.

Line j

Add line e and line i. This total must be less than

$500,000 in order to satisfy the second statutory hardship

Primary contact information — Enter the name, telephone

exemption criterion.

number, and fax number of your primary contact as designated in

your enrollment information.

Example:

The total of line e and line i is $230,850.

Line a

Enter the total sales and compensating use tax from the

most recently completed quarter and the month/year of the

Check the box next to each exemption criterion that has been met.

quarter ended. You must attach a copy of the

In order to qualify for hardship exemption consideration, both criteria

corresponding Form ST-810 when submitting this

must be met. XYZ Corporation has met both hardship exemption

form.

criteria.

Example:

Certification section

For the quarter ended 5/95, this figure is $62,500.

This form must be signed and dated by an individual authorized to

act on behalf of the vendor. The fact that an individual’s name is

Line b

Enter the total sales and compensating use tax from the

signed on the certification will be prima facie evidence that the

same quarter as in line a for the prior year and the

individual is authorized to sign and certify this information.

month/year when the quarter ended.

Note: If you are a required participant in the EFT program for more

Example:

than one tax, exemption from participation in the program for one tax

For the quarter ended 5/94, this figure is $150,000.

type does not release you from mandatory participation in the

program for any other tax for which you may qualify. You must

Line c

Enter the total sales and compensating use tax from the

demonstrate hardship for each individual tax by submitting the

quarter immediately preceding the most recently

applicable exemption form.

completed quarter and the month/year when the quarter

The completed form should be mailed to:

ended.

NYS TAX DEPARTMENT

Example:

PROMPTAX

For the quarter ended 2/95, the figure is $87,500.

BUILDING 8

Line d

Enter the total sales and compensating use tax from the

W A HARRIMAN CAMPUS

same quarter as in line c for the prior year and the

ALBANY NY 12227

month/year when the quarter ended.

For assistance in completing this form, call:

Example:

1 800 EFT-0054

(1 800 338-0054)

For the quarter ended 2/94, the figure is $175,000.

1

1 2

2