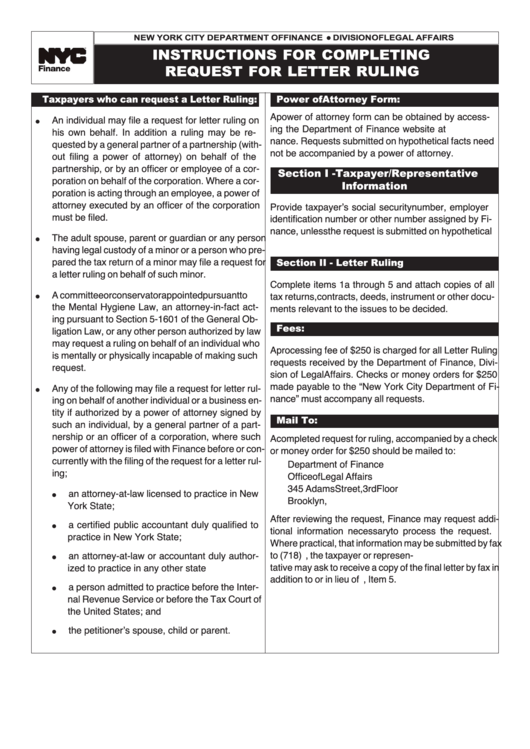

Instructions For Completing Request For Letter Ruling - Department Of Finance

ADVERTISEMENT

NEW YORK CITY DEPARTMENT OF FINANCE

DIVISION OF LEGAL AFFAIRS

G

INSTRUCTIONS FOR COMPLETING

REQUEST FOR LETTER RULING

Taxpayers who can request a Letter Ruling:

Power of Attorney Form:

A power of attorney form can be obtained by access-

An individual may file a request for letter ruling on

ing the Department of Finance website at nyc.gov/fi-

his own behalf. In addition a ruling may be re-

G

nance. Requests submitted on hypothetical facts need

quested by a general partner of a partnership (with-

not be accompanied by a power of attorney.

out filing a power of attorney) on behalf of the

partnership, or by an officer or employee of a cor-

Section I - Taxpayer/Representative

poration on behalf of the corporation. Where a cor-

Information

poration is acting through an employee, a power of

attorney executed by an officer of the corporation

Provide taxpayerʼs social security number, employer

must be filed.

identification number or other number assigned by Fi-

nance, unless the request is submitted on hypothetical

The adult spouse, parent or guardian or any person

facts. Indicate contact number and email address.

having legal custody of a minor or a person who pre-

G

pared the tax return of a minor may file a request for

Section II - Letter Ruling

a letter ruling on behalf of such minor.

Complete items 1a through 5 and attach copies of all

A committee or conservator appointed pursuant to

tax returns, contracts, deeds, instrument or other docu-

the Mental Hygiene Law, an attorney-in-fact act-

ments relevant to the issues to be decided.

G

ing pursuant to Section 5-1601 of the General Ob-

ligation Law, or any other person authorized by law

Fees:

may request a ruling on behalf of an individual who

A processing fee of $250 is charged for all Letter Ruling

is mentally or physically incapable of making such

requests received by the Department of Finance, Divi-

request.

sion of Legal Affairs. Checks or money orders for $250

made payable to the “New York City Department of Fi-

Any of the following may file a request for letter rul-

nance” must accompany all requests.

ing on behalf of another individual or a business en-

G

tity if authorized by a power of attorney signed by

such an individual, by a general partner of a part-

Mail To:

nership or an officer of a corporation, where such

A completed request for ruling, accompanied by a check

power of attorney is filed with Finance before or con-

or money order for $250 should be mailed to:

currently with the filing of the request for a letter rul-

Department of Finance

ing;

Office of Legal Affairs

345 Adams Street, 3rd Floor

an attorney-at-law licensed to practice in New

Brooklyn, N.Y. 11201

York State;

G

After reviewing the request, Finance may request addi-

a certified public accountant duly qualified to

tional information necessary to process the request.

practice in New York State;

G

Where practical, that information may be submitted by fax

to (718) 403-3899. In addition, the taxpayer or represen-

an attorney-at-law or accountant duly author-

tative may ask to receive a copy of the final letter by fax in

ized to practice in any other state

G

addition to or in lieu of mailing. See Section II, Item 5.

a person admitted to practice before the Inter-

nal Revenue Service or before the Tax Court of

G

the United States; and

the petitionerʼs spouse, child or parent.

G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1