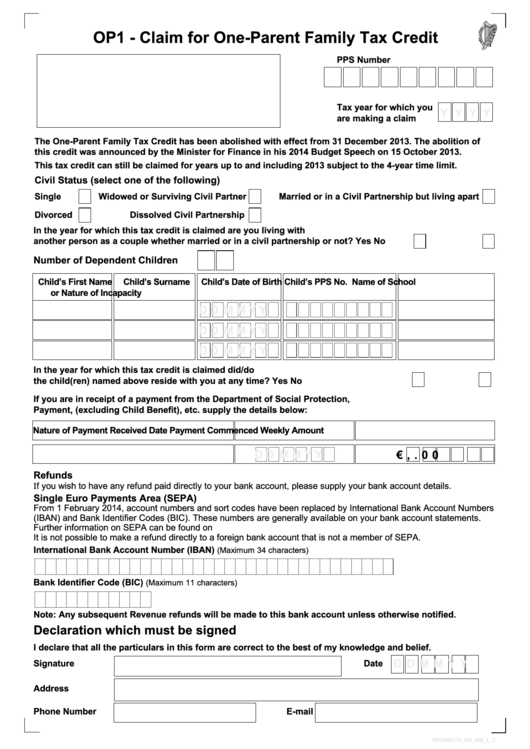

OP1 - Claim for One-Parent Family Tax Credit

PPS Number

Tax year for which you

Y Y Y Y

are making a claim

The One-Parent Family Tax Credit has been abolished with effect from 31 December 2013. The abolition of

this credit was announced by the Minister for Finance in his 2014 Budget Speech on 15 October 2013.

This tax credit can still be claimed for years up to and including 2013 subject to the 4-year time limit.

Civil Status (select one of the following)

Single

Widowed or Surviving Civil Partner

Married or in a Civil Partnership but living apart

Divorced

Dissolved Civil Partnership

In the year for which this tax credit is claimed are you living with

another person as a couple whether married or in a civil partnership or not?

Yes

No

Number of Dependent Children

Child’s First Name

Child’s Surname

Child’s Date of Birth

Child’s PPS No.

Name of School

or Nature of Incapacity

D D M M Y Y

D D M M Y Y

D D M M Y Y

In the year for which this tax credit is claimed did/do

the child(ren) named above reside with you at any time?

Yes

No

If you are in receipt of a payment from the Department of Social Protection, e.g. One-Parent Family

Payment, (excluding Child Benefit), etc. supply the details below:

Nature of Payment Received

Date Payment Commenced

Weekly Amount

D D M M Y Y

€

,

. 0 0

Refunds

If you wish to have any refund paid directly to your bank account, please supply your bank account details.

Single Euro Payments Area (SEPA)

From 1 February 2014, account numbers and sort codes have been replaced by International Bank Account Numbers

(IBAN) and Bank Identifier Codes (BIC). These numbers are generally available on your bank account statements.

Further information on SEPA can be found on

It is not possible to make a refund directly to a foreign bank account that is not a member of SEPA.

International Bank Account Number (IBAN)

(Maximum 34 characters)

Bank Identifier Code (BIC)

(Maximum 11 characters)

Note: Any subsequent Revenue refunds will be made to this bank account unless otherwise notified.

Declaration which must be signed

I declare that all the particulars in this form are correct to the best of my knowledge and belief.

D D M M Y Y

Signature

Date

Address

Phone Number

E-mail

RPC004175_EN_WB_L_2

1

1 2

2