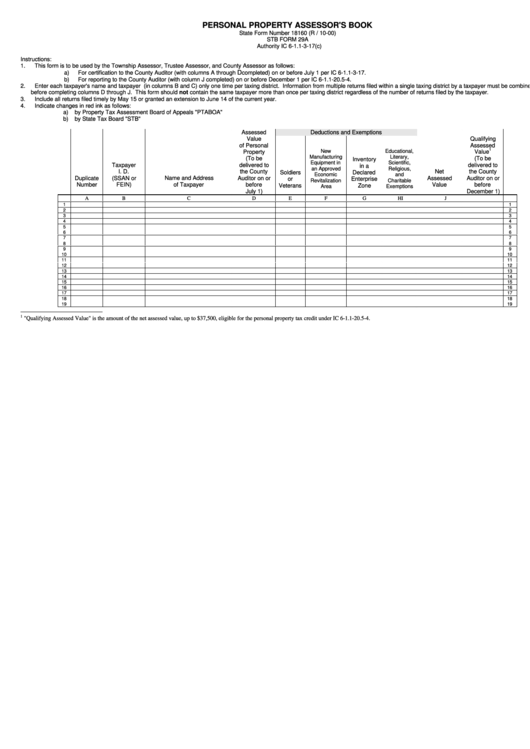

PERSONAL PROPERTY ASSESSOR'S BOOK

State Form Number 18160 (R / 10-00)

STB FORM 29A

Authority IC 6-1.1-3-17(c)

Instructions:

1. This form is to be used by the Township Assessor, Trustee Assessor, and County Assessor as follows:

D

a) For certification to the County Auditor (with columns A through

completed) on or before July 1 per IC 6-1.1-3-17.

b) For reporting to the County Auditor (with column J completed) on or before December 1 per IC 6-1.1-20.5-4.

2. Enter each taxpayer's name and taxpayer I.D. (in columns B and C) only one time per taxing district. Information from multiple returns filed within a single taxing district by a taxpayer must be combined

before completing columns D through J. This form should not contain the same taxpayer more than once per taxing district regardless of the number of returns filed by the taxpayer.

3. Include all returns filed timely by May 15 or granted an extension to June 14 of the current year.

4. Indicate changes in red ink as follows:

a)

by Property Tax Assessment Board of Appeals "PTABOA"

b)

by State Tax Board "STB"

Assessed

Deductions and Exemptions

Value

Qualifying

of Personal

Assessed

1

New

Educational,

Property

Value

Manufacturing

Literary,

(To be

(To be

Inventory

Equipment in

Scientific,

Taxpayer

delivered to

delivered to

in a

an Approved

Religious,

I. D.

the County

Net

the County

Soldiers

Declared

Economic

and

Duplicate

(SSAN or

Name and Address

Auditor on or

Assessed

Auditor on or

or

Enterprise

Revitalization

Charitable

Number

FEIN)

of Taxpayer

before

Value

before

Veterans

Zone

Area

Exemptions

July 1)

December 1)

A

B

C

D

E

F

G

H

I

J

1

1

2

2

3

3

4

4

5

5

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13

14

14

15

15

16

16

17

17

18

18

19

19

1

"Qualifying Assessed Value" is the amount of the net assessed value, up to $37,500, eligible for the personal property tax credit under IC 6-1.1-20.5-4.

1

1 2

2