Special Tax Assessment For Rehabilitated Historic Properties - Town Of Fort Mill

ADVERTISEMENT

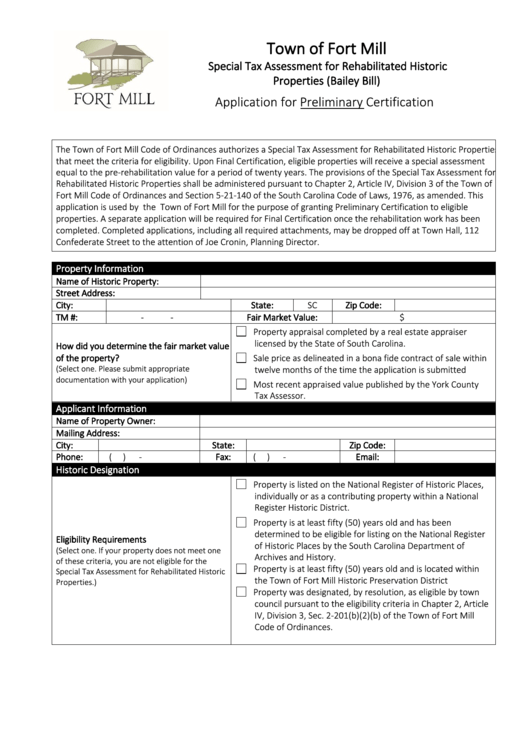

Town of Fort Mill

Special Tax Assessment for Rehabilitated Historic

Properties (Bailey Bill)

Application for Preliminary Certification

The Town of Fort Mill Code of Ordinances authorizes a Special Tax Assessment for Rehabilitated Historic Properties

that meet the criteria for eligibility. Upon Final Certification, eligible properties will receive a special assessment

equal to the pre-rehabilitation value for a period of twenty years. The provisions of the Special Tax Assessment for

Rehabilitated Historic Properties shall be administered pursuant to Chapter 2, Article IV, Division 3 of the Town of

Fort Mill Code of Ordinances and Section 5-21-140 of the South Carolina Code of Laws, 1976, as amended. This

application is used by the Town of Fort Mill for the purpose of granting Preliminary Certification to eligible

properties. A separate application will be required for Final Certification once the rehabilitation work has been

completed. Completed applications, including all required attachments, may be dropped off at Town Hall, 112

Confederate Street to the attention of Joe Cronin, Planning Director.

Property Information

Name of Historic Property:

Street Address:

City:

State:

SC

Zip Code:

TM #:

-

-

Fair Market Value:

$

Property appraisal completed by a real estate appraiser

licensed by the State of South Carolina.

How did you determine the fair market value

of the property?

Sale price as delineated in a bona fide contract of sale within

(Select one. Please submit appropriate

twelve months of the time the application is submitted

documentation with your application)

Most recent appraised value published by the York County

Tax Assessor.

Applicant Information

Name of Property Owner:

Mailing Address:

City:

State:

Zip Code:

Phone:

(

)

-

Fax:

(

)

-

Email:

Historic Designation

Property is listed on the National Register of Historic Places,

individually or as a contributing property within a National

Register Historic District.

Property is at least fifty (50) years old and has been

determined to be eligible for listing on the National Register

Eligibility Requirements

of Historic Places by the South Carolina Department of

(Select one. If your property does not meet one

Archives and History.

of these criteria, you are not eligible for the

Property is at least fifty (50) years old and is located within

Special Tax Assessment for Rehabilitated Historic

the Town of Fort Mill Historic Preservation District

Properties.)

Property was designated, by resolution, as eligible by town

council pursuant to the eligibility criteria in Chapter 2, Article

IV, Division 3, Sec. 2-201(b)(2)(b) of the Town of Fort Mill

Code of Ordinances.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3