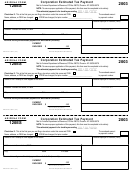

Form 112-Ep - Colorado Estimated Tax Vouchers For Corporations - 2003 Page 3

ADVERTISEMENT

INSTRUCTIONS FOR

2003 CORPORATION ESTIMATED INCOME TAX, FORM 112-EP

1.

Corporations that must pay estimated tax. Corporations

5.

Payments. File your estimated tax payments in the same

are required to pay Colorado estimated income tax during

manner (separate, consolidated, combined) and using the

same account number that you expect to use in filing your

the taxable year if it can reasonably be anticipated that the

corporation's Colorado tax liability for the tax year will

income tax return. If you make payments for a state account

exceed $5,000. See FYI Income 51 for more information.

number other than the number you will use to file your

Colorado income tax return, you must notify the Department

2.

Short taxable year. Estimated tax must be filed for a short

of Revenue of this discrepancy in writing.

taxable year if the tax is expected to exceed $5,000 plus

Send the information to:

Taxpayer Services

estimated credits. If the short taxable year results from a

change in the accounting period, the income must be placed

Income Tax Section

on an annual basis, in which case the requirement for paying

Denver CO 80261-0005

will be the same as instruction 1.

6.

Tax rate. The Colorado Corporation income tax rate is

3.

Due date for filing.. Estimated tax payments are due in four

4.63% of Colorado taxable income.

equal installments on April 15, 2003, June 15, 2003, Sep-

7.

Application of overpayment credit. An estimated tax

tember 15, 2003 and December 15, 2003. The payments will

be due for a fiscal year filer on the 15th day of 4th, 6th, 9th

credit resulting from an overpayment of tax on the

and 12th month of the tax year. The payments will be due for

corporation's income tax return for the immediately preced-

ing taxable year must be applied in its entirety against the

a short tax year on the 15th day of 4th, 6th, and 9th months,

whichever apply, plus a final payment on the 15th day of the

first estimated tax payments coming due.

last month of the tax year. Payments will be credited against

the earliest quarterly installment that is due for the tax year

8.

Penalty for failure to pay estimated tax. The estimated tax

regardless of when the payment is received. If the due date

penalty will be assessed if the required estimated tax pay-

is a Saturday, Sunday, or legal holiday, payment on the next

ments are not paid in a timely manner. The penalty will be the

business day will be accepted as having been made on the

appropriate Colorado income tax interest rate times the

underpayment for each quarter times the underpayment

due date.

period. This penalty is computed on Form 205.

4.

Required annual payment. The required annual payment

No penalty is due if the net tax plus the recapture of prior year

is the lesser of:

1.) 70% of actual Colorado tax liability, or

credits, minus the estimated tax credits and payments, is less

than $5,000.

2.) 100% of preceding years Colorado tax liability.

This only applies if

9.

Where to file. Estimated tax payments should be filed with

•

The preceding year was 12 month tax year, and

the Colorado Department of Revenue, Denver, Colorado

•

The corporation filed a Colorado return, and

80261-0008. Make checks or money orders payable to the

Colorado Department of Revenue.

•

The corporation is not defined under section 6655

of the federal IRS code as a large corporation*.

10.

Additional information. All forms, FYIs, and other infor-

mation are available at or you can call

* Large corporations can base their first quarter estimated

tax payment on 25% of the previous year's tax liability.

for forms at (303) 238-FAST (3278) or information at (303)

However, future payments must be based on the actual tax

238-SERV (7378).

liability for the current tax year and any underpayment

occurring in the first quarter as a result of this estimation

must be repaid with the second quarterly payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3