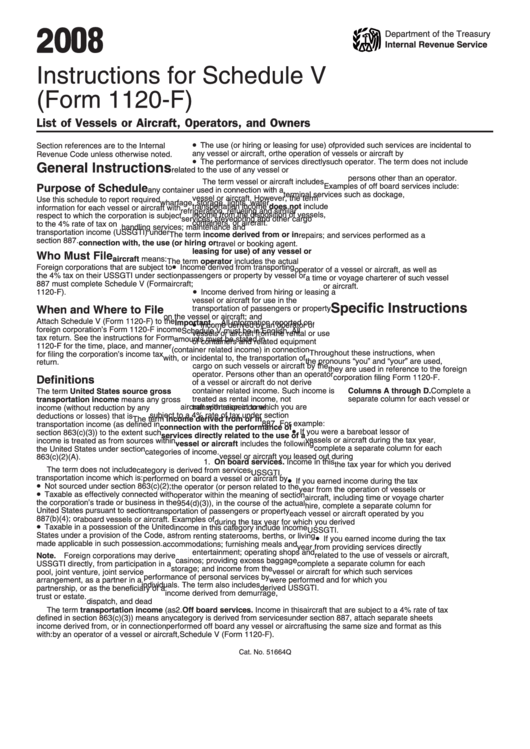

Instructions For Schedule V (Form 1120-F) - Department Of The Treasury - 2008

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Schedule V

(Form 1120-F)

List of Vessels or Aircraft, Operators, and Owners

•

The use (or hiring or leasing for use) of

provided such services are incidental to

Section references are to the Internal

any vessel or aircraft, or

the operation of vessels or aircraft by

Revenue Code unless otherwise noted.

•

The performance of services directly

such operator. The term does not include

General Instructions

related to the use of any vessel or aircraft.

income from services performed by

persons other than an operator.

The term vessel or aircraft includes

Examples of off board services include:

Purpose of Schedule

any container used in connection with a

terminal services such as dockage,

vessel or aircraft. However, the term

Use this schedule to report required

wharfage, storage, lights, water,

transportation income does not include

information for each vessel or aircraft with

refrigeration, refueling and similar

income from the disposition of vessels,

respect to which the corporation is subject

services; stevedoring and other cargo

containers, or aircraft.

to the 4% rate of tax on U.S. source gross

handling services; maintenance and

transportation income (USSGTI) under

The term income derived from or in

repairs; and services performed as a

section 887.

connection with, the use (or hiring or

travel or booking agent.

leasing for use) of any vessel or

Who Must File

aircraft means:

The term operator includes the actual

•

Foreign corporations that are subject to

Income derived from transporting

operator of a vessel or aircraft, as well as

the 4% tax on their USSGTI under section

passengers or property by vessel or

a time or voyage charterer of such vessel

887 must complete Schedule V (Form

aircraft;

or aircraft.

•

1120-F).

Income derived from hiring or leasing a

vessel or aircraft for use in the

Specific Instructions

When and Where to File

transportation of passengers or property

on the vessel or aircraft; and

Attach Schedule V (Form 1120-F) to the

•

Important. All information reported on

Income derived by an operator of

foreign corporation’s Form 1120-F income

Schedule V must be in English. All

vessels or aircraft from the rental or use

tax return. See the instructions for Form

amounts must be stated in U.S. dollars.

of containers and related equipment

1120-F for the time, place, and manner

(container related income) in connection

Throughout these instructions, when

for filing the corporation’s income tax

with, or incidental to, the transportation of

the pronouns “you” and “your” are used,

return.

cargo on such vessels or aircraft by the

they are used in reference to the foreign

operator. Persons other than an operator

corporation filing Form 1120-F.

Definitions

of a vessel or aircraft do not derive

container related income. Such income is

Columns A through D. Complete a

The term United States source gross

treated as rental income, not

separate column for each vessel or

transportation income means any gross

transportation income.

aircraft with respect to which you are

income (without reduction by any

subject to a 4% rate of tax under section

deductions or losses) that is

The term income derived from or in

887. For example:

transportation income (as defined in

connection with the performance of

•

If you were a bareboat lessor of

section 863(c)(3)) to the extent such

services directly related to the use of a

vessels or aircraft during the tax year,

income is treated as from sources within

vessel or aircraft includes the following

complete a separate column for each

the United States under section

categories of income.

vessel or aircraft you leased out during

863(c)(2)(A).

1. On board services. Income in this

the tax year for which you derived

The term does not include

category is derived from services

USSGTI.

transportation income which is:

•

performed on board a vessel or aircraft by

If you earned income during the tax

•

Not sourced under section 863(c)(2);

the operator (or person related to the

year from the operation of vessels or

•

Taxable as effectively connected with

operator within the meaning of section

aircraft, including time or voyage charter

the corporation’s trade or business in the

954(d)(3)), in the course of the actual

hire, complete a separate column for

United States pursuant to section

transportation of passengers or property

each vessel or aircraft operated by you

887(b)(4); or

aboard vessels or aircraft. Examples of

during the tax year for which you derived

•

Taxable in a possession of the United

income in this category include income

USSGTI.

States under a provision of the Code, as

•

from renting staterooms, berths, or living

If you earned income during the tax

made applicable in such possession.

accommodations; furnishing meals and

year from providing services directly

entertainment; operating shops and

related to the use of vessels or aircraft,

Note. Foreign corporations may derive

casinos; providing excess baggage

complete a separate column for each

USSGTI directly, from participation in a

storage; and income from the

vessel or aircraft for which such services

pool, joint venture, joint service

performance of personal services by

were performed and for which you

arrangement, as a partner in a

individuals. The term also includes

derived USSGTI.

partnership, or as the beneficiary of a

income derived from demurrage,

trust or estate.

dispatch, and dead freight.

If you have more than 4 vessels or

The term transportation income (as

2. Off board services. Income in this

aircraft that are subject to a 4% rate of tax

defined in section 863(c)(3)) means any

category is derived from services

under section 887, attach separate sheets

income derived from, or in connection

performed off board any vessel or aircraft

using the same size and format as this

with:

by an operator of a vessel or aircraft,

Schedule V (Form 1120-F).

Cat. No. 51664Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2