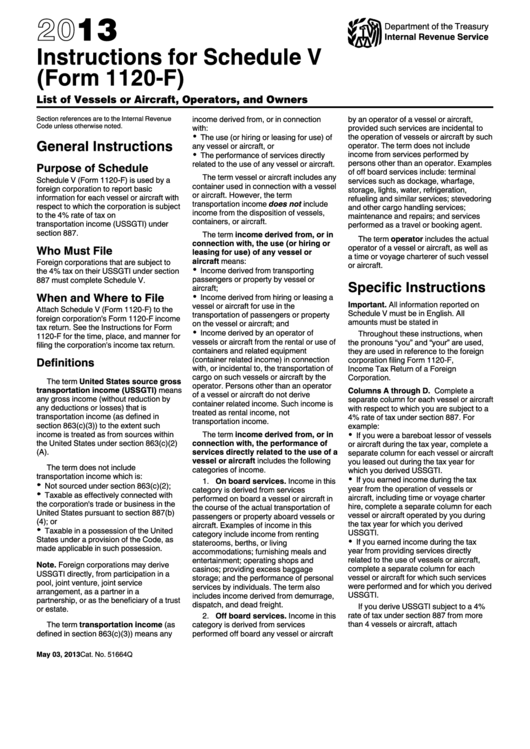

Instructions For Schedule V (Form 1120-F) - List Of Vessels Or Aircraft, Operators, And Owners - 2013

ADVERTISEMENT

2013

Department of the Treasury

Internal Revenue Service

Instructions for Schedule V

(Form 1120-F)

List of Vessels or Aircraft, Operators, and Owners

income derived from, or in connection

by an operator of a vessel or aircraft,

Section references are to the Internal Revenue

Code unless otherwise noted.

with:

provided such services are incidental to

The use (or hiring or leasing for use) of

the operation of vessels or aircraft by such

General Instructions

operator. The term does not include

any vessel or aircraft, or

income from services performed by

The performance of services directly

persons other than an operator. Examples

related to the use of any vessel or aircraft.

Purpose of Schedule

of off board services include: terminal

The term vessel or aircraft includes any

Schedule V (Form 1120-F) is used by a

services such as dockage, wharfage,

container used in connection with a vessel

foreign corporation to report basic

storage, lights, water, refrigeration,

or aircraft. However, the term

information for each vessel or aircraft with

refueling and similar services; stevedoring

transportation income does not include

respect to which the corporation is subject

and other cargo handling services;

income from the disposition of vessels,

to the 4% rate of tax on U.S. source gross

maintenance and repairs; and services

containers, or aircraft.

transportation income (USSGTI) under

performed as a travel or booking agent.

section 887.

The term income derived from, or in

The term operator includes the actual

connection with, the use (or hiring or

Who Must File

operator of a vessel or aircraft, as well as

leasing for use) of any vessel or

a time or voyage charterer of such vessel

aircraft means:

Foreign corporations that are subject to

or aircraft.

Income derived from transporting

the 4% tax on their USSGTI under section

passengers or property by vessel or

887 must complete Schedule V.

Specific Instructions

aircraft;

When and Where to File

Income derived from hiring or leasing a

Important. All information reported on

vessel or aircraft for use in the

Attach Schedule V (Form 1120-F) to the

Schedule V must be in English. All

transportation of passengers or property

foreign corporation's Form 1120-F income

amounts must be stated in U.S. dollars.

on the vessel or aircraft; and

tax return. See the Instructions for Form

Income derived by an operator of

Throughout these instructions, when

1120-F for the time, place, and manner for

vessels or aircraft from the rental or use of

the pronouns “you” and “your” are used,

filing the corporation's income tax return.

containers and related equipment

they are used in reference to the foreign

(container related income) in connection

Definitions

corporation filing Form 1120-F, U.S.

with, or incidental to, the transportation of

Income Tax Return of a Foreign

cargo on such vessels or aircraft by the

Corporation.

The term United States source gross

operator. Persons other than an operator

transportation income (USSGTI) means

Columns A through D. Complete a

of a vessel or aircraft do not derive

any gross income (without reduction by

separate column for each vessel or aircraft

container related income. Such income is

any deductions or losses) that is

with respect to which you are subject to a

treated as rental income, not

transportation income (as defined in

4% rate of tax under section 887. For

transportation income.

section 863(c)(3)) to the extent such

example:

income is treated as from sources within

The term income derived from, or in

If you were a bareboat lessor of vessels

the United States under section 863(c)(2)

connection with, the performance of

or aircraft during the tax year, complete a

(A).

services directly related to the use of a

separate column for each vessel or aircraft

vessel or aircraft includes the following

you leased out during the tax year for

The term does not include

categories of income.

which you derived USSGTI.

transportation income which is:

If you earned income during the tax

1. On board services. Income in this

Not sourced under section 863(c)(2);

year from the operation of vessels or

category is derived from services

Taxable as effectively connected with

aircraft, including time or voyage charter

performed on board a vessel or aircraft in

the corporation's trade or business in the

hire, complete a separate column for each

the course of the actual transportation of

United States pursuant to section 887(b)

vessel or aircraft operated by you during

passengers or property aboard vessels or

(4); or

the tax year for which you derived

aircraft. Examples of income in this

Taxable in a possession of the United

USSGTI.

category include income from renting

States under a provision of the Code, as

If you earned income during the tax

staterooms, berths, or living

made applicable in such possession.

year from providing services directly

accommodations; furnishing meals and

related to the use of vessels or aircraft,

entertainment; operating shops and

Note. Foreign corporations may derive

complete a separate column for each

casinos; providing excess baggage

USSGTI directly, from participation in a

vessel or aircraft for which such services

storage; and the performance of personal

pool, joint venture, joint service

were performed and for which you derived

services by individuals. The term also

arrangement, as a partner in a

USSGTI.

includes income derived from demurrage,

partnership, or as the beneficiary of a trust

dispatch, and dead freight.

If you derive USSGTI subject to a 4%

or estate.

rate of tax under section 887 from more

2. Off board services. Income in this

than 4 vessels or aircraft, attach

The term transportation income (as

category is derived from services

defined in section 863(c)(3)) means any

performed off board any vessel or aircraft

May 03, 2013

Cat. No. 51664Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2