Schedule Nr - General Instructions

ADVERTISEMENT

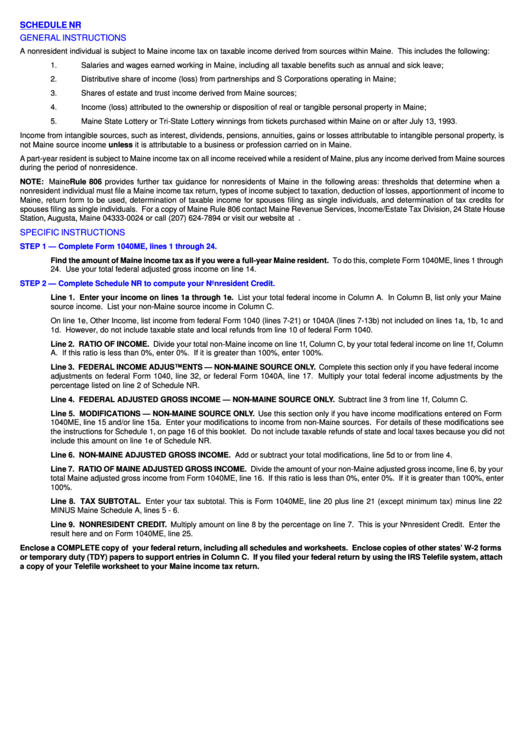

SCHEDULE NR

GENERAL INSTRUCTIONS

A nonresident individual is subject to Maine income tax on taxable income derived from sources within Maine. This includes the following:

1.

Salaries and wages earned working in Maine, including all taxable benefits such as annual and sick leave;

2.

Distributive share of income (loss) from partnerships and S Corporations operating in Maine;

3.

Shares of estate and trust income derived from Maine sources;

4.

Income (loss) attributed to the ownership or disposition of real or tangible personal property in Maine;

5.

Maine State Lottery or Tri-State Lottery winnings from tickets purchased within Maine on or after July 13, 1993.

Income from intangible sources, such as interest, dividends, pensions, annuities, gains or losses attributable to intangible personal property, is

not Maine source income unless it is attributable to a business or profession carried on in Maine.

A part-year resident is subject to Maine income tax on all income received while a resident of Maine, plus any income derived from Maine sources

during the period of nonresidence.

NOTE: Maine Rule 806 provides further tax guidance for nonresidents of Maine in the following areas: thresholds that determine when a

nonresident individual must file a Maine income tax return, types of income subject to taxation, deduction of losses, apportionment of income to

Maine, return form to be used, determination of taxable income for spouses filing as single individuals, and determination of tax credits for

spouses filing as single individuals. For a copy of Maine Rule 806 contact Maine Revenue Services, Income/Estate Tax Division, 24 State House

Station, Augusta, Maine 04333-0024 or call (207) 624-7894 or visit our website at

SPECIFIC INSTRUCTIONS

STEP 1 — Complete Form 1040ME, lines 1 through 24.

Find the amount of Maine income tax as if you were a full-year Maine resident. To do this, complete Form 1040ME, lines 1 through

24. Use your total federal adjusted gross income on line 14.

STEP 2 — Complete Schedule NR to compute your Nonresident Credit.

Line 1. Enter your income on lines 1a through 1e. List your total federal income in Column A. In Column B, list only your Maine

source income. List your non-Maine source income in Column C.

On line 1e, Other Income, list income from federal Form 1040 (lines 7-21) or 1040A (lines 7-13b) not included on lines 1a, 1b, 1c and

1d. However, do not include taxable state and local refunds from line 10 of federal Form 1040.

Line 2. RATIO OF INCOME. Divide your total non-Maine income on line 1f, Column C, by your total federal income on line 1f, Column

A. If this ratio is less than 0%, enter 0%. If it is greater than 100%, enter 100%.

Line 3. FEDERAL INCOME ADJUSTMENTS — NON-MAINE SOURCE ONLY. Complete this section only if you have federal income

adjustments on federal Form 1040, line 32, or federal Form 1040A, line 17. Multiply your total federal income adjustments by the

percentage listed on line 2 of Schedule NR.

Line 4. FEDERAL ADJUSTED GROSS INCOME — NON-MAINE SOURCE ONLY. Subtract line 3 from line 1f, Column C.

Line 5. MODIFICATIONS — NON-MAINE SOURCE ONLY. Use this section only if you have income modifications entered on Form

1040ME, line 15 and/or line 15a. Enter your modifications to income from non-Maine sources. For details of these modifications see

the instructions for Schedule 1, on page 16 of this booklet. Do not include taxable refunds of state and local taxes because you did not

include this amount on line 1e of Schedule NR.

Line 6. NON-MAINE ADJUSTED GROSS INCOME. Add or subtract your total modifications, line 5d to or from line 4.

Line 7. RATIO OF MAINE ADJUSTED GROSS INCOME. Divide the amount of your non-Maine adjusted gross income, line 6, by your

total Maine adjusted gross income from Form 1040ME, line 16. If this ratio is less than 0%, enter 0%. If it is greater than 100%, enter

100%.

Line 8. TAX SUBTOTAL. Enter your tax subtotal. This is Form 1040ME, line 20 plus line 21 (except minimum tax) minus line 22

MINUS Maine Schedule A, lines 5 - 6.

Line 9. NONRESIDENT CREDIT. Multiply amount on line 8 by the percentage on line 7. This is your Nonresident Credit. Enter the

result here and on Form 1040ME, line 25.

Enclose a COMPLETE copy of your federal return, including all schedules and worksheets. Enclose copies of other states’ W-2 forms

or temporary duty (TDY) papers to support entries in Column C. If you filed your federal return by using the IRS Telefile system, attach

a copy of your Telefile worksheet to your Maine income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5