Schedule Nr Instructions - 2014

ADVERTISEMENT

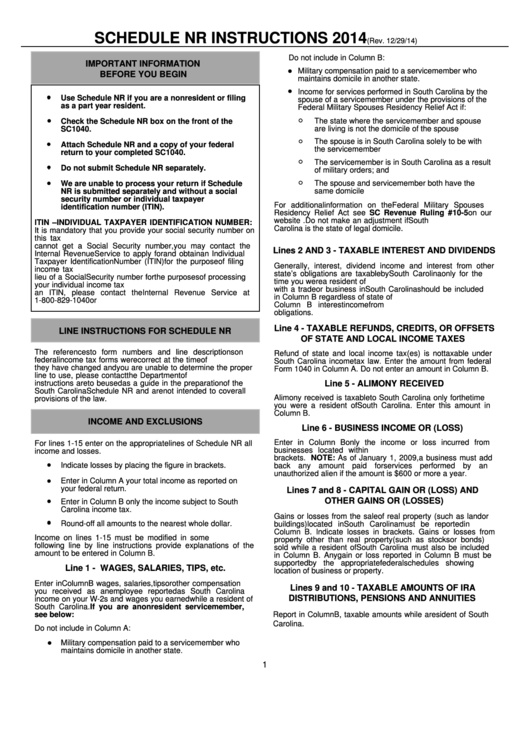

SCHEDULE NR INSTRUCTIONS 2014

(Rev. 12/29/14)

Do not include in Column B:

IMPORTANT INFORMATION

Military compensation paid to a servicemember who

BEFORE YOU BEGIN

maintains domicile in another state.

Income for services performed in South Carolina by the

Use Schedule NR if you are a nonresident or filing

spouse of a servicemember under the provisions of the

as a part year resident.

Federal Military Spouses Residency Relief Act if:

The state where the servicemember and spouse

Check the Schedule NR box on the front of the

are living is not the domicile of the spouse

SC1040.

The spouse is in South Carolina solely to be with

Attach Schedule NR and a copy of your federal

the servicemember

return to your completed SC1040.

The servicemember is in South Carolina as a result

Do not submit Schedule NR separately.

of military orders; and

We are unable to process your return if Schedule

The spouse and servicemember both have the

same domicile

NR is submitted separately and without a social

security number or individual taxpayer

For additional information on the Federal Military Spouses

identification number (ITIN).

Residency Relief Act see SC Revenue Ruling #10-5 on our

website Do not make an adjustment if South

ITIN – INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER:

Carolina is the state of legal domicile.

It is mandatory that you provide your social security number on

this tax form. If you are a nonresident or resident alien and

cannot get a Social Security number, you may contact the

Lines 2 AND 3 - TAXABLE INTEREST AND DIVIDENDS

Internal Revenue Service to apply for and obtain an Individual

Taxpayer Identification Number (ITIN) for the purpose of filing

Generally, interest, dividend income and interest from other

income tax returns. South Carolina will accept this number in

state’s obligations are taxable by South Carolina only for the

lieu of a Social Security number for the purposes of processing

time you were a resident of South Carolina. Interest connected

your individual income tax returns. For information on obtaining

with a trade or business in South Carolina should be included

an ITIN, please contact the Internal Revenue Service at

in Column B regardless of state of residency. Do not include in

1-800-829-1040 or

Column B interest income from U.S. or South Carolina

obligations.

Line 4 - TAXABLE REFUNDS, CREDITS, OR OFFSETS

LINE INSTRUCTIONS FOR SCHEDULE NR

OF STATE AND LOCAL INCOME TAXES

The references to form numbers and line descriptions on

Refund of state and local income tax(es) is not taxable under

federal income tax forms were correct at the time of printing. If

South Carolina income tax law. Enter the amount from federal

they have changed and you are unable to determine the proper

Form 1040 in Column A. Do not enter an amount in Column B.

line to use, please contact the Department of Revenue. These

instructions are to be used as a guide in the preparation of the

Line 5 - ALIMONY RECEIVED

South Carolina Schedule NR and are not intended to cover all

Alimony received is taxable to South Carolina only for the time

provisions of the law.

you were a resident of South Carolina. Enter this amount in

Column B.

INCOME AND EXCLUSIONS

Line 6 - BUSINESS INCOME OR (LOSS)

Enter in Column B only the income or loss incurred from

For lines 1-15 enter on the appropriate lines of Schedule NR all

businesses located within S.C. Indicate business losses in

income and losses.

brackets. NOTE: As of January 1, 2009, a business must add

Indicate losses by placing the figure in brackets.

back any amount paid for services performed by an

unauthorized alien if the amount is $600 or more a year.

Enter in Column A your total income as reported on

your federal return.

Lines 7 and 8 - CAPITAL GAIN OR (LOSS) AND

OTHER GAINS OR (LOSSES)

Enter in Column B only the income subject to South

Carolina income tax.

Gains or losses from the sale of real property (such as land or

Round-off all amounts to the nearest whole dollar.

buildings) located in South Carolina must be reported in

Column B. Indicate losses in brackets. Gains or losses from

Income on lines 1-15 must be modified in some cases. The

property other than real property (such as stocks or bonds)

following line by line instructions provide explanations of the

sold while a resident of South Carolina must also be included

amount to be entered in Column B.

in Column B. Any gain or loss reported in Column B must be

supported by the appropriate federal schedules showing

Line 1 - WAGES, SALARIES, TIPS, etc.

location of business or property.

Enter in Column B wages, salaries, tips or other compensation

Lines 9 and 10 - TAXABLE AMOUNTS OF IRA

you received as an employee reported as South Carolina

DISTRIBUTIONS, PENSIONS AND ANNUITIES

income on your W-2s and wages you earned while a resident of

South Carolina. If you are a nonresident servicemember,

see below:

Report in Column B, taxable amounts while a resident of South

Carolina.

Do not include in Column A:

Military compensation paid to a servicemember who

maintains domicile in another state.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5