Port Cargo Volume Increase Credit Instructions

ADVERTISEMENT

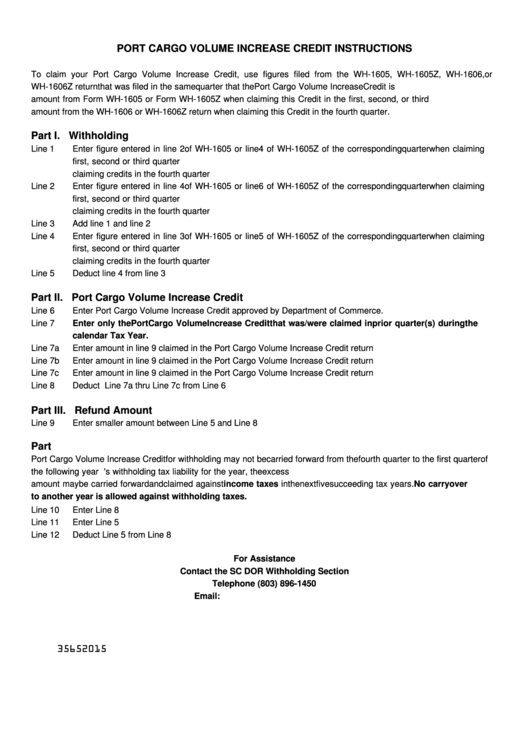

PORT CARGO VOLUME INCREASE CREDIT INSTRUCTIONS

To claim your Port Cargo Volume Increase Credit, use figures filed from the WH-1605, WH-1605Z, WH-1606, or

WH-1606Z return that was filed in the same quarter that the Port Cargo Volume Increase Credit is being claimed. Use the

amount from Form WH-1605 or Form WH-1605Z when claiming this Credit in the first, second, or third quarter. Use the

amount from the WH-1606 or WH-1606Z return when claiming this Credit in the fourth quarter.

Part I. Withholding

Line 1

Enter figure entered in line 2 of WH-1605 or line 4 of WH-1605Z of the corresponding quarter when claiming

first, second or third quarter credit. Enter figure entered in line 2 of WH-1606 or line 4 of the WH-1606Z when

claiming credits in the fourth quarter

Line 2

Enter figure entered in line 4 of WH-1605 or line 6 of WH-1605Z of the corresponding quarter when claiming

first, second or third quarter credit. Enter figure entered in line 4 of WH-1606 or line 6 of the WH-1606Z when

claiming credits in the fourth quarter

Line 3

Add line 1 and line 2

Line 4

Enter figure entered in line 3 of WH-1605 or line 5 of WH-1605Z of the corresponding quarter when claiming

first, second or third quarter credit. Enter figure entered in line 3 of WH-1606 or line 5 of the WH-1606Z when

claiming credits in the fourth quarter

Line 5

Deduct line 4 from line 3

Part II. Port Cargo Volume Increase Credit

Line 6

Enter Port Cargo Volume Increase Credit approved by Department of Commerce.

Line 7

Enter only the Port Cargo Volume Increase Credit that was/were claimed in prior quarter(s) during the

calendar Tax Year.

Line 7a

Enter amount in line 9 claimed in the Port Cargo Volume Increase Credit return

Line 7b

Enter amount in line 9 claimed in the Port Cargo Volume Increase Credit return

Line 7c

Enter amount in line 9 claimed in the Port Cargo Volume Increase Credit return

Line 8

Deduct Line 7a thru Line 7c from Line 6

Part III. Refund Amount

Line 9

Enter smaller amount between Line 5 and Line 8

Part IV. Credits Carried Forward to the Next Quarter

Port Cargo Volume Increase Credit for withholding may not be carried forward from the fourth quarter to the first quarter of

the following year against withholding. If the credit exceeds the taxpayer's withholding tax liability for the year, the excess

amount may be carried forward and claimed against income taxes in the next five succeeding tax years. No carryover

to another year is allowed against withholding taxes.

Line 10

Enter Line 8

Line 11

Enter Line 5

Line 12

Deduct Line 5 from Line 8

For Assistance

Contact the SC DOR Withholding Section

Telephone (803) 896-1450

Email:

35652015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1