Form Sc Sch.tc-30 - Port Cargo Volume Increase Income Tax Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-30

DEPARTMENT OF REVENUE

PORT CARGO VOLUME INCREASE

(Rev. 8/6/13)

INCOME TAX CREDIT

3419

20

Attach to your Income Tax Return

Names As Shown On Tax Return

SSN or FEIN

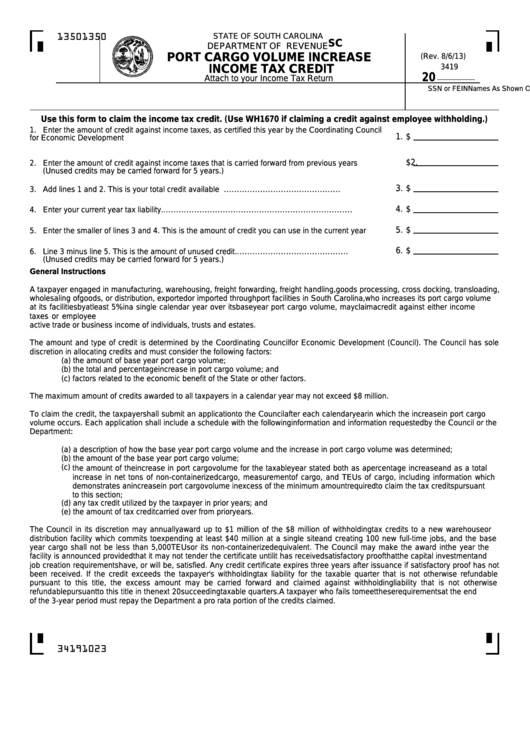

Use this form to claim the income tax credit. (Use WH1670 if claiming a credit against employee withholding.)

1. Enter the amount of credit against income taxes, as certified this year by the Coordinating Council

1.

$

for Economic Development ..................................................................................................................

2.

$

2. Enter the amount of credit against income taxes that is carried forward from previous years .............

(Unused credits may be carried forward for 5 years.)

.

3.

$

3. Add lines 1 and 2. This is your total credit available .....………………………………………..................

4.

$

4. Enter your current year tax liability..………………………………………………………………................

5.

$

5. Enter the smaller of lines 3 and 4. This is the amount of credit you can use in the current year .........

6.

$

6. Line 3 minus line 5. This is the amount of unused credit..……………………………………..................

(Unused credits may be carried forward for 5 years.)

General Instructions

A taxpayer engaged in manufacturing, warehousing, freight forwarding, freight handling, goods processing, cross docking, transloading,

wholesaling of goods, or distribution, exported or imported through port facilities in South Carolina, who increases its port cargo volume

at its facilities by at least 5% in a single calendar year over its base year port cargo volume, may claim a credit against either income

taxes or employee withholding. The income tax credit can be claimed against corporate income tax or the tax on the pass-through

active trade or business income of individuals, trusts and estates.

The amount and type of credit is determined by the Coordinating Council for Economic Development (Council). The Council has sole

discretion in allocating credits and must consider the following factors:

(a) the amount of base year port cargo volume;

(b) the total and percentage increase in port cargo volume; and

(c) factors related to the economic benefit of the State or other factors.

The maximum amount of credits awarded to all taxpayers in a calendar year may not exceed $8 million.

To claim the credit, the taxpayer shall submit an application to the Council after each calendar year in which the increase in port cargo

volume occurs. Each application shall include a schedule with the following information and information requested by the Council or the

Department:

(a) a description of how the base year port cargo volume and the increase in port cargo volume was determined;

(b) the amount of the base year port cargo volume;

(c)

the amount of the increase in port cargo volume for the taxable year stated both as a percentage increase and as a total

increase in net tons of non-containerized cargo, measurement of cargo, and TEUs of cargo, including information which

demonstrates an increase in port cargo volume in excess of the minimum amount required to claim the tax credits pursuant

to this section;

(d) any tax credit utilized by the taxpayer in prior years; and

(e) the amount of tax credit carried over from prior years.

The Council in its discretion may annually award up to $1 million of the $8 million of withholding tax credits to a new warehouse or

distribution facility which commits to expending at least $40 million at a single site and creating 100 new full-time jobs, and the base

year cargo shall not be less than 5,000 TEUs or its non-containerized equivalent. The Council may make the award in the year the

facility is announced provided that it may not tender the certificate until it has received satisfactory proof that the capital investment and

job creation requirements have, or will be, satisfied. Any credit certificate expires three years after issuance if satisfactory proof has not

been received. If the credit exceeds the taxpayer's withholding tax liability for the taxable quarter that is not otherwise refundable

pursuant to this title, the excess amount may be carried forward and claimed against withholding liability that is not otherwise

refundable pursuant to this title in the next 20 succeeding taxable quarters. A taxpayer who fails to meet these requirements at the end

of the 3-year period must repay the Department a pro rata portion of the credits claimed.

34191023

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2