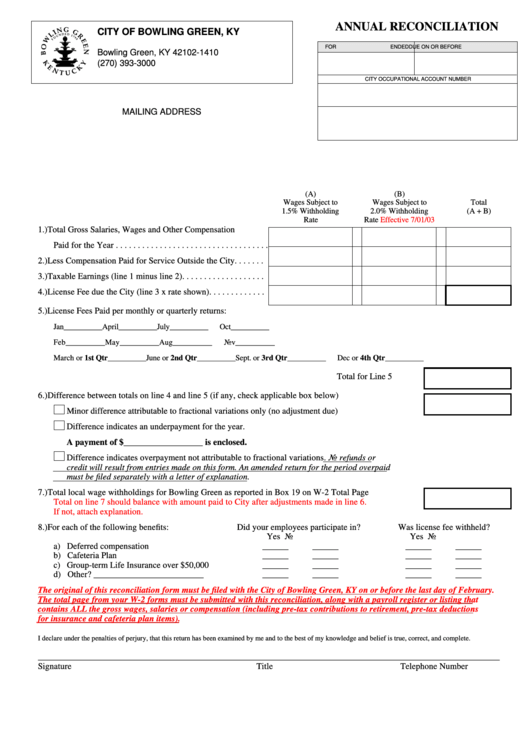

ANNUAL RECONCILIATION

CITY OF BOWLING GREEN, KY

P.O. Box 1410

FOR

ENDED

DUE ON OR BEFORE

Bowling Green, KY 42102-1410

(270) 393-3000

CITY OCCUPATIONAL ACCOUNT NUMBER

MAILING ADDRESS

(A)

(B)

Wages Subject to

Wages Subject to

Total

1.5% Withholding

2.0% Withholding

(A + B)

Rate

Rate

Effective 7/01/03

1.) Total Gross Salaries, Wages and Other Compensation

Paid for the Year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.) Less Compensation Paid for Service Outside the City. . . . . . .

3.) Taxable Earnings (line 1 minus line 2). . . . . . . . . . . . . . . . . . .

4.) License Fee due the City (line 3 x rate shown). . . . . . . . . . . . .

5.) License Fees Paid per monthly or quarterly returns:

Jan

__________

April

__________

July

__________

Oct

__________

Feb

__________

May

__________

Aug

__________

Nov

__________

March or 1st Qtr __________

June or 2nd Qtr __________

Sept. or 3rd Qtr

__________

Dec or 4th Qtr __________

Total for Line 5

6.) Difference between totals on line 4 and line 5 (if any, check applicable box below)

Minor difference attributable to fractional variations only (no adjustment due)

Difference indicates an underpayment for the year.

A payment of $__________________ is enclosed.

Difference indicates overpayment not attributable to fractional variations. No refunds or

credit will result from entries made on this form. An amended return for the period overpaid

must be filed separately with a letter of explanation.

7.) Total local wage withholdings for Bowling Green as reported in Box 19 on W-2 Total Page

Total on line 7 should balance with amount paid to City after adjustments made in line 6.

If not, attach explanation.

8.) For each of the following benefits:

Did your employees participate in?

Was license fee withheld?

Yes

No

Yes

No

a) Deferred compensation

______

______

______

______

b) Cafeteria Plan

______

______

______

______

c) Group-term Life Insurance over $50,000

______

______

______

______

d) Other? _________________________

______

______

______

______

The original of this reconciliation form must be filed with the City of Bowling Green, KY on or before the last day of February.

The total page from your W-2 forms must be submitted with this reconciliation, along with a payroll register or listing that

contains ALL the gross wages, salaries or compensation (including pre-tax contributions to retirement, pre-tax deductions

for insurance and cafeteria plan items).

I declare under the penalties of perjury, that this return has been examined by me and to the best of my knowledge and belief is true, correct, and complete.

__________________________________________________________________________________________________________

Signature

Title

Telephone Number

1

1