Form 1n - Nonprofit Organization Status Report & Election Of Payment Method - 2001 Page 2

ADVERTISEMENT

DWS-UI

Page 2

Form 1N

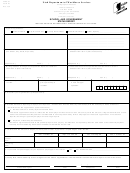

16b. Type of acquisition:

Change of ownership

Merger or reorganization

Sale, lease or sub-lease

Purchased assets through court

Other, please explain:

16c. Did you acquire all or a portion of the previous organization?

90% or more

Less than 90%

16d. Did you retain all of the previous organization employees?

Yes

No

16e. Is the previous organization still in business?

Yes

No

16f. Was the previous organization closed prior to acquisition?

Yes

No

If Yes, date closed:__________________

17. Enter below the amount of wages you have paid in Utah. If you have not paid wages enter “NONE”.

Jan. 1 to Mar. 31

Apr. 1 to Jun. 30

Jul. 1 to Sep. 30

Oct. 1 to Dec. 31

Current Year:

Preceding Year:

18. If you have not paid wages, do you expect to in the future?

Yes

No

Estimated date: _______________________

Election of Method of Reporting and Payment

19. This election is available only to nonprofit organizations which have received the exemption for the Federal Income Tax under Section 501(c)(3)

of the Internal Revenue Code. If you are subject to the Act and have received the Federal Income Tax exemption, you are a Contributory

employer unless you elect to reimburse the Unemployment Insurance Fund.

This decision must be made by an individual or individuals with the authority to make financial commitments for the organization.

Important

(Please read instructions carefully.)

a. Reimbursement of Unemployment Benefits Paid

This organization elects to reimburse the Unemployment Compensation Fund an amount equal to the amount of any regular benefits and

one-half of the extended benefits paid that are attributable to the service performed by former employees of this organization. This

election requires the filing of quarterly employment and wage reports.

The initial election of “Reimbursement of Unemployment Benefits Paid” will remain in effect for a minimum of one calendar year. If a

change in election of method is desired, submit a written notice not later than thirty (30) days prior to the beginning of the next calendar

year. Subsequent elections remain in effect for a minimum of two calendar years. Section 35A-4-309 of the Utah Employment Security

Act.

b. Payment of Quarterly Contributions

This organization elects to file quarterly contribution (tax) reports and pay contributions on taxable wages as required by Section

35A-4-302 & 303 of the Utah Employment Security Act.

I certify that I am an authorized agent for the above organization and that the information contained in this report is true and correct.

Name

Title

Telephone Number

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2