Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 12

ADVERTISEMENT

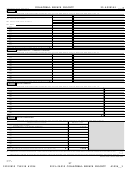

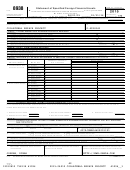

COLLATERAL REPAIR PROJECT

20-4928141

11

Form 990 (2015)

Page

Part X

Balance Sheet

†

Check if Schedule O contains a response or note to any line in this Part X

(A)

(B)

Beginning of year

End of year

53099.

110786.

1

Cash - non-interest-bearing

~~~~~~~~~~~~~~~~~~~~~~~~~

1

2

Savings and temporary cash investments

~~~~~~~~~~~~~~~~~~

2

3

Pledges and grants receivable, net

~~~~~~~~~~~~~~~~~~~~~

3

4

Accounts receivable, net ~~~~~~~~~~~~~~~~~~~~~~~~~~

4

5

Loans and other receivables from current and former officers, directors,

trustees, key employees, and highest compensated employees. Complete

Part II of Schedule L ~~~~~~~~~~~~~~~~~~~~~~~~~~~~

5

Loans and other receivables from other disqualified persons (as defined under

6

section 4958(f)(1)), persons described in section 4958(c)(3)(B), and contributing

employers and sponsoring organizations of section 501(c)(9) voluntary

employees' beneficiary organizations (see instr). Complete Part II of Sch L ~~

6

7

Notes and loans receivable, net

~~~~~~~~~~~~~~~~~~~~~~~

7

8

Inventories for sale or use

~~~~~~~~~~~~~~~~~~~~~~~~~~

8

9

Prepaid expenses and deferred charges

~~~~~~~~~~~~~~~~~~

9

10

a

Land, buildings, and equipment: cost or other

basis. Complete Part VI of Schedule D

~~~

10a

b

Less: accumulated depreciation

~~~~~~

10b

10c

11

Investments - publicly traded securities

~~~~~~~~~~~~~~~~~~~

11

12

Investments - other securities. See Part IV, line 11

~~~~~~~~~~~~~~

12

13

Investments - program-related. See Part IV, line 11

~~~~~~~~~~~~~

13

14

Intangible assets

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

14

1277.

1277.

15

Other assets. See Part IV, line 11 ~~~~~~~~~~~~~~~~~~~~~~

15

54376.

112063.

16

Total assets.

Add lines 1 through 15 (must equal line 34)

16

17

Accounts payable and accrued expenses

~~~~~~~~~~~~~~~~~~

17

18

Grants payable

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

18

19

Deferred revenue

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

19

20

Tax-exempt bond liabilities

~~~~~~~~~~~~~~~~~~~~~~~~~

20

21

Escrow or custodial account liability. Complete Part IV of Schedule D

~~~~

21

Loans and other payables to current and former officers, directors, trustees,

22

key employees, highest compensated employees, and disqualified persons.

Complete Part II of Schedule L ~~~~~~~~~~~~~~~~~~~~~~~

22

23

Secured mortgages and notes payable to unrelated third parties ~~~~~~

23

24

Unsecured notes and loans payable to unrelated third parties ~~~~~~~~

24

25

Other liabilities (including federal income tax, payables to related third

parties, and other liabilities not included on lines 17-24). Complete Part X of

1241.

1388.

Schedule D

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

25

1241.

1388.

26

Total liabilities.

Add lines 17 through 25

26

X

†

Organizations that follow SFAS 117 (ASC 958), check here

|

and

complete lines 27 through 29, and lines 33 and 34.

53135.

110675.

27

Unrestricted net assets

~~~~~~~~~~~~~~~~~~~~~~~~~~~

27

28

Temporarily restricted net assets

~~~~~~~~~~~~~~~~~~~~~~

28

29

Permanently restricted net assets

~~~~~~~~~~~~~~~~~~~~~

29

†

Organizations that do not follow SFAS 117 (ASC 958), check here

|

and complete lines 30 through 34.

30

30

Capital stock or trust principal, or current funds

~~~~~~~~~~~~~~~

31

31

Paid-in or capital surplus, or land, building, or equipment fund

~~~~~~~~

32

32

Retained earnings, endowment, accumulated income, or other funds

~~~~

53135.

110675.

33

33

Total net assets or fund balances ~~~~~~~~~~~~~~~~~~~~~~

54376.

112063.

34

34

Total liabilities and net assets/fund balances

990

Form

(2015)

532011

12-16-15

11

12030810 758338 41096

2015.04010 COLLATERAL REPAIR PROJECT

41096__1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44