Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 35

ADVERTISEMENT

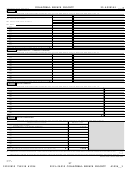

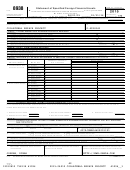

Noncash Contributions

SCHEDULE M

OMB No. 1545-0047

2015

(Form 990)

J

Complete if the organizations answered "Yes" on Form 990, Part IV, lines 29 or 30.

J

Attach to Form 990.

Open To Public

Department of the Treasury

Inspection

Internal Revenue Service

J

Information about Schedule M (Form 990) and its instructions is at

Name of the organization

Employer identification number

COLLATERAL REPAIR PROJECT

20-4928141

Part I

Types of Property

(a)

(b)

(c)

(d)

Number of

Noncash contribution

Check if

Method of determining

contributions or

amounts reported on

applicable

noncash contribution amounts

items contributed

Form 990, Part VIII, line 1g

1

Art - Works of art

~~~~~~~~~~~~~

2

Art - Historical treasures

~~~~~~~~~

Art - Fractional interests

~~~~~~~~~~

3

Books and publications

~~~~~~~~~~

4

X

29388.THRIFT STORE VALUE

Clothing and household goods

~~~~~~

5

Cars and other vehicles

6

~~~~~~~~~~

Boats and planes

7

~~~~~~~~~~~~~

Intellectual property

8

~~~~~~~~~~~

9

Securities - Publicly traded

~~~~~~~~

10

Securities - Closely held stock

~~~~~~~

11

Securities - Partnership, LLC, or

trust interests

~~~~~~~~~~~~~~

12

Securities - Miscellaneous

~~~~~~~~

Qualified conservation contribution -

13

Historic structures

~~~~~~~~~~~~

Qualified conservation contribution - Other

14

~

15

Real estate - Residential

~~~~~~~~~

16

Real estate - Commercial

~~~~~~~~~

17

Real estate - Other

~~~~~~~~~~~~

18

Collectibles

~~~~~~~~~~~~~~~~

X

12

8129.PRICE OF COMPARABLE

19

Food inventory

~~~~~~~~~~~~~~

20

Drugs and medical supplies

~~~~~~~~

21

Taxidermy

~~~~~~~~~~~~~~~~

22

Historical artifacts

~~~~~~~~~~~~

23

Scientific specimens

~~~~~~~~~~~

24

Archeological artifacts

~~~~~~~~~~

SCHOOL SUPPLI

X

2

845.PRICE OF COMPARABLE

J

25

Other

(

)

J

26

Other

(

)

J

27

Other

(

)

J

28

Other

(

)

29

Number of Forms 8283 received by the organization during the tax year for contributions

for which the organization completed Form 8283, Part IV, Donee Acknowledgement ~~~~

29

Yes

No

30

a

During the year, did the organization receive by contribution any property reported in Part I, lines 1 through 28, that it

must hold for at least three years from the date of the initial contribution, and which is not required to be used for

X

exempt purposes for the entire holding period? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

30a

b

If "Yes," describe the arrangement in Part II.

X

31

Does the organization have a gift acceptance policy that requires the review of any non-standard contributions? ~~~~~~

31

32

a

Does the organization hire or use third parties or related organizations to solicit, process, or sell noncash

X

contributions? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

32a

b

If "Yes," describe in Part II.

33

If the organization did not report an amount in column (c) for a type of property for which column (a) is checked,

describe in Part II.

LHA

For Paperwork Reduction Act Notice, see the Instructions for Form 990.

Schedule M (Form 990) (2015)

532141

08-21-15

34

12030810 758338 41096

2015.04010 COLLATERAL REPAIR PROJECT

41096__1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44