Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 31

ADVERTISEMENT

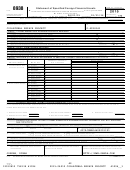

COLLATERAL REPAIR PROJECT

20-4928141

Schedule F (Form 990) 2015

Page

2

Part II

Grants and Other Assistance to Organizations or Entities Outside the United States.

Complete if the organization answered "Yes" on Form 990, Part IV, line 15, for any

recipient who received more than $5,000. Part II can be duplicated if additional space is needed.

1

(g)

Amount of

(h)

Description

(i)

Method of

IRS code section

(b)

(d)

Purpose of

(e)

Amount

(f)

Manner of

(a)

Name of organization

(c)

Region

non-cash

of non-cash

valuation (book, FMV,

and EIN (if applicable)

grant

of cash grant

cash disbursement

assistance

assistance

appraisal, other)

2

Enter total number of recipient organizations listed above that are recognized as charities by the foreign country, recognized as tax-exempt by

the IRS, or for which the grantee or counsel has provided a section 501(c)(3) equivalency letter ~~~~~~~~~~~~~~~~~~~~~~~ |

3

Enter total number of other organizations or entities |

Schedule F (Form 990) 2015

532072

30

10-01-15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44