Form 725 Draft - Schedule Cp - Individually Owned Composite Return - 2015 Page 2

ADVERTISEMENT

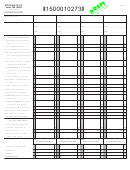

SCHEDULE CP

Page 2

Form 725 (2015)

*1500010273*

41A725CP

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Name of Owner

A

KY Corp/LLET Acct No.

A

KY Corp/LLET Acct No.

A

KY Corp/LLET Acct No.

A

KY Corp/LLET Acct No.

Social Security Number

B

B

B

B

Name ___________________________

Name ___________________________

Name ___________________________

Name ___________________________

FEIN ___________________________

FEIN ___________________________

FEIN ___________________________

FEIN ___________________________

Part II—

LLET Computation

1. Schedule LLET, Section D,

line 1 .....................................

1

00 1

00 1

00 1

00

2. Tax credit recapture .............

2

00 2

00 2

00 2

00

3. Total (add lines 1 and 2) ......

3

00 3

00 3

00 3

00

4. Nonrefundable LLET credit

from Kentucky Schedule(s)

K-1 ........................................

4

00 4

00 4

00 4

00

5. Nonrefundable tax credits

(attach Schedule TCS) ..........

5

00 5

00 5

00 5

00

6. LLET liability (greater of line

3 less lines 4 and 5 or $175

minimum) .............................

6

00 6

00 6

00 6

00

7. Estimated tax payments .....

7

00 7

00 7

00 7

00

8. Certified rehabilitation tax

credit .....................................

8

00 8

00 8

00 8

00

9. Film industry tax credit .......

9

00 9

00 9

00 9

00

10. Extension payment .............

10

00 10

00 10

00 10

00

11. Prior year’s tax credit ..........

11

00 11

00 11

00 11

00

12. LLET due (line 6 less lines 7

through 11) ...........................

12

00 12

00 12

00 12

00

13. LLET overpayment (lines 7

through 11 less line 6) .........

13

00 13

00 13

00 13

00

14. Credited to 2015 Interest .....

14

00 14

00 14

00 14

00

15. Credited to 2015 Penalty .....

15

00 15

00 15

00 15

00

16. Credited to 2016 LLET ..........

16

00 16

00 16

00 16

00

17. Amount to be refunded ......

17

00 17

00 17

00 17

00

Part III—LLET Credit

1. LLET liability (Part II, the

1

00 1

00 1

00 1

00

total of lines 4 and 6) ...........

2. Minimum tax .......................

2

175 00 2

175 00 2

175 00 2

175 00

3. Member’s LLET credit

3

00 3

00 3

00 3

00

(line 1 less line 2) .................

Tax Payment Summary

Tax Payment Summary

Tax Payment Summary

Tax Payment Summary

1.

1 $

00 1 $

00 1 $

00 1 $

00

LLET due (Part II, line 12)

2

2 $

00 2 $

00 2 $

00 2 $

00

. Interest

3

3 $

00 3 $

00 3 $

00 3 $

00

. Penalty

4 $

00 4 $

00 4 $

00 4 $

00

4. Total Payment

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2