Instructions For Composite Individual Return For Nonresident Partners Or Shareholders

ADVERTISEMENT

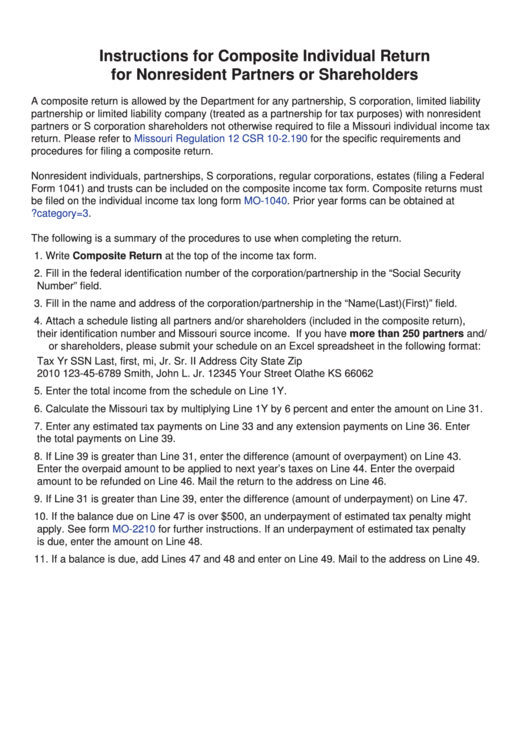

Instructions for Composite Individual Return

for Nonresident Partners or Shareholders

A composite return is allowed by the Department for any partnership, S corporation, limited liability

partnership or limited liability company (treated as a partnership for tax purposes) with nonresident

partners or S corporation shareholders not otherwise required to file a Missouri individual income tax

return. Please refer to

Missouri Regulation 12 CSR 10-2.190

for the specific requirements and

procedures for filing a composite return.

Nonresident individuals, partnerships, S corporations, regular corporations, estates (filing a Federal

Form 1041) and trusts can be included on the composite income tax form. Composite returns must

be filed on the individual income tax long form MO-1040. Prior year forms can be obtained at

The following is a summary of the procedures to use when completing the return.

1. Write Composite Return at the top of the income tax form.

2. Fill in the federal identification number of the corporation/partnership in the “Social Security

Number” field.

3. Fill in the name and address of the corporation/partnership in the “Name(Last)(First)” field.

4. Attach a schedule listing all partners and/or shareholders (included in the composite return),

their identification number and Missouri source income. If you have more than 250 partners and/

or shareholders, please submit your schedule on an Excel spreadsheet in the following format:

Tax Yr

SSN

Last, first, mi, Jr. Sr. II

Address

City

State

Zip

2010

123-45-6789

Smith, John L. Jr.

12345 Your Street

Olathe

KS

66062

5. Enter the total income from the schedule on Line 1Y.

6. Calculate the Missouri tax by multiplying Line 1Y by 6 percent and enter the amount on Line 31.

7. Enter any estimated tax payments on Line 33 and any extension payments on Line 36. Enter

the total payments on Line 39.

8. If Line 39 is greater than Line 31, enter the difference (amount of overpayment) on Line 43.

Enter the overpaid amount to be applied to next year’s taxes on Line 44. Enter the overpaid

amount to be refunded on Line 46. Mail the return to the address on Line 46.

9. If Line 31 is greater than Line 39, enter the difference (amount of underpayment) on Line 47.

10. If the balance due on Line 47 is over $500, an underpayment of estimated tax penalty might

apply. See form

MO-2210

for further instructions. If an underpayment of estimated tax penalty

is due, enter the amount on Line 48.

11. If a balance is due, add Lines 47 and 48 and enter on Line 49. Mail to the address on Line 49.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1